UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

RENOVORX, INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ No fee required.

☐ Fee paid previously with preliminary materials.

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11.

RENOVORX, INC.

4546 El Camino Real, Suite B1

Los Altos, CA 94022

NOTICE

OF SPECIAL MEETING OF STOCKHOLDERS

to be held on December 15, 2023

TO THE STOCKHOLDERS OF RENOVO RX, INC.:

Dear Stockholder:

You are invited to attend a Special Meeting of Stockholders (the “Special Meeting”) of RenovoRx, Inc. (“Renovo” “the Company” “we” “us” or “our”), which will be held on December 15, 2023 at 10:00 a.m., Pacific Time, at the Company’s principal executive offices at 4546 El Camino Real Suite B1, Los Altos, California, for the following purposes:

(1) To approve of the issuance of securities in one or more non-public offerings where the maximum discount at which securities will be offered will be equivalent to a discount of up to 10% below the market price of our common stock, as required by and in accordance with Nasdaq Marketplace Rule 5635(d); and

(2) To consider and vote upon a proposal to adjourn the Special Meeting to a later date or dates, if necessary, to permit further solicitation and vote of proxies if, based upon the tabulated vote at the time of the Special Meeting, there are not sufficient votes to approve Proposal No. 1.

Stockholders of record of the Company’s Common Stock at the close of business on November 21, 2023 (the “Record Date”) are entitled to notice of, and to vote at, the Special Meeting or any adjournment or postponement thereof.

Your attention is directed to the Proxy Statement accompanying this Notice for a more complete statement of matters to be considered at the Special Meeting.

It is anticipated the attached proxy statement and the enclosed proxy card will first be mailed on or about November 28, 2023 to stockholders entitled to vote as of the close of business on the Record Date. These proxy materials contain instructions on how to access this proxy statement online at: https://annualgeneralmeetings.com/rnxtsp2023, and how to submit your proxy to vote via the internet or mail.

Whether or not you plan to attend the Special Meeting, your vote is very important and we encourage you to vote promptly. After reading the attached proxy statement, please promptly mark, sign and date the enclosed proxy card and return it by following the instructions on the proxy card or voting instruction card or online. If you attend the Special Meeting, you will have the right to revoke the proxy and vote your shares in person. If you hold your shares through an account with a brokerage firm, bank, or other nominee, please follow the instructions you receive from your brokerage firm, bank, or other nominee to vote your shares.

| By Order of the Board of Directors, | |

| /s/ Shaun Bagai | |

| Shaun R. Bagai | |

| Chief Executive Officer | |

| Dated: November 27, 2023 |

RENOVO RX, INC.

4546 El Camino Real, Suite B1

Los Altos, CA 94022

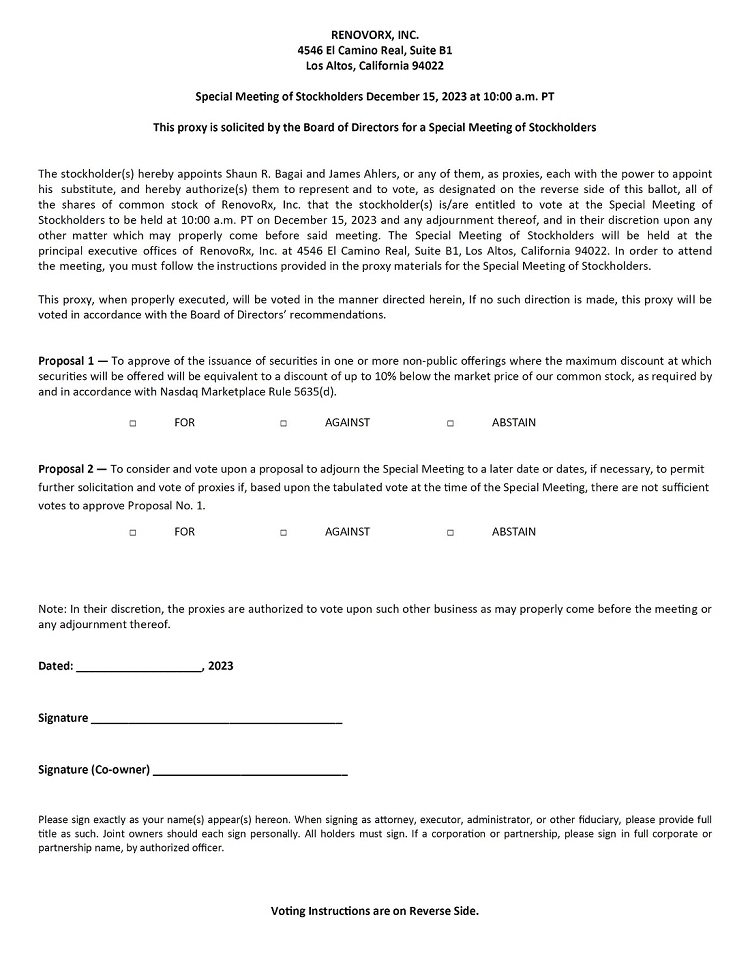

PROXY

STATEMENT

for

Special Meeting of Stockholders

to be held December 15, 2023

The Company is soliciting proxies on behalf of the Board in connection with the Special Meeting of Renovo Rx, Inc, on December 15, 2023 at 10:00 a.m., Pacific Time, at the Company’s principal executive offices at 4546 El Camino Real Suite B1, Los Altos, California, for the following purposes:

(1) To approve of the issuance of securities in one or more non-public offerings where the maximum discount at which securities will be offered will be equivalent to a discount of up to 10% below the market price of our common stock, as required by and in accordance with Nasdaq Marketplace Rule 5635(d); and

(2) To consider and vote upon a proposal to adjourn the Special Meeting to a later date or dates, if necessary, to permit further solicitation and vote of proxies if, based upon the tabulated vote at the time of the Special Meeting, there are not sufficient votes to approve Proposal No. 1.

The Board set November 21, 2023 as the Record Date to determine those holders of the Common Stock who are entitled to notice of, and to vote at, the Special Meeting. A list of the stockholders entitled to vote at the meeting may be examined at the Company’s office at during the 10-day period preceding the Special Meeting.

It is anticipated that on or about November 28, 2023, the Company will commence mailing to all stockholders of record, as of the Record Date, this proxy statement and the enclosed proxy card. These proxy materials contain instructions on how to access this proxy statement online at: https://annualgeneralmeetings.com/rnxtsp2023, and how to submit your proxy to vote via the internet, or by mail.

IMPORTANT: Please mark, date, and sign the enclosed proxy card and promptly return it in the accompanying postage-paid envelope or vote online to assure that your shares are represented at the Special Meeting.

GENERAL INFORMATION ABOUT VOTING

Proxy Materials

Why am I receiving these materials?

The Board of the Company will deliver printed versions of these materials to you by mail on or around November 28, 2023, in connection with the solicitation of proxies for use at the Company’s Special Meeting, which will take place on December 15, 2023, at 10:00 a.m., Pacific Time, at the Company’s principal executive offices at 4546 El Camino Real Suite B1, Los Altos, California.

As a stockholder, you are invited to attend the Special Meeting, and are requested to vote on the proposals described in this proxy statement. This proxy statement includes information that we are required to provide to you under Securities and Exchange Commission (“SEC”) rules and is designed to assist you in voting your shares.

What is included in these materials?

The proxy materials include:

● |

this proxy statement for the Special Meeting; and |

| ● | the proxy card or a voting instruction card for the Special Meeting. |

What shares are included on the proxy card?

If you are a stockholder of record in the Record Date, you will receive only one proxy card for all the shares you hold of record in certificate form and in book-entry form.

If you are a beneficial owner, you will receive voting instructions from your broker, bank or other holder of record.

What is “householding” and how does it affect me?

The Company has adopted a procedure called “householding,” which the SEC has approved. Under this procedure, if requested to deliver proxy materials, we deliver a single copy of the proxy materials to multiple stockholders who share the same address unless we have received contrary instructions from one or more of the stockholders. This procedure reduces our printing and mailing costs, and the environmental impact of our annual meetings. Stockholders who participate in householding will continue to be able to access and receive separate proxy cards. Upon written or oral request, we will deliver promptly a separate copy of the proxy materials to any stockholder at a shared address to which we delivered a single copy of any of these documents.

To receive a separate copy of the proxy statement and proxy card, you may contact us at the following address and phone number:

RenovoRx, Inc.

Corporate Secretary

4546 El Camino Real, Suite B1

Los Altos, CA 94022

Telephone: (560) 284-4433

Stockholders who hold shares in “street name” (as described below) may contact their brokerage firm, bank, broker-dealer or other similar organization to request information about householding.

Voting Information

What items of business will be voted on at the Special Meeting?

The items of business to be voted on by stockholders at the Special Meeting are:

(1) To approve of the issuance of securities in one or more non-public offerings where the maximum discount at which securities will be offered will be equivalent to a discount of up to 10% below the market price of our common stock, as required by and in accordance with Nasdaq Marketplace Rule 5635(d); and

(2) To consider and vote upon a proposal to adjourn the Special Meeting to a later date or dates, if necessary, to permit further solicitation and vote of proxies if, based upon the tabulated vote at the time of the Special Meeting, there are not sufficient votes to approve Proposal No. 1.

How does the Board recommend that I vote?

The Board unanimously recommends that you vote your shares:

| ● | “FOR” approving Proposal No. 1 relating to the issuance of shares of our Common Stock representing more than 20% of our Common Stock outstanding upon the conversion of the Convertible Notes and the exercise of the Warrants in accordance with Nasdaq Marketplace Rule 5635(d); |

| ● | “FOR” approving adjourning the Special Meeting to a later date or dates, if necessary, to permit further solicitation and vote of proxies if, based upon the tabulated vote at the time of the Special Meeting, there are not sufficient votes to approve the Proposal No. 1. |

Who is entitled to vote at the Special Meeting?

Only stockholders of record at the close of business on the Record Date will be entitled to vote at the Special Meeting. As of the Record Date, shares of the Common Stock were outstanding and entitled to vote. Each share of Common Stock outstanding on the Record Date is entitled to one vote on each proposal.

Is there a list of stockholders entitled to vote at the Special Meeting?

The names of stockholders of record entitled to vote at the Special Meeting will be available for ten days prior to the Special Meeting at our principal executive offices at 4546 El Camino Real, Suite B1, Los Altos, CA 94022.

If you would like to examine the list for any purpose germane to the Special Meeting prior to the meeting date, please contact our Corporate Secretary.

How can I vote if I own shares directly?

Most stockholders do not own shares registered directly in their name, but rather are “beneficial holders” of shares held in a stock brokerage account or by a bank or other nominee (that is, shares held “in street name”). Those stockholders should refer to “How can I vote if my shares are held in a stock brokerage account, or by a bank or other nominee?” below for instructions regarding how to vote their shares.

If, however, your shares are registered directly in your name with our transfer agent, Pacific Stock Transfer, Inc., you are considered, with respect to those shares, the stockholder of record, and these proxy materials are being sent directly to you. You may vote in the following ways:

| ● | By Mail: Votes may be cast by mail, as long as the proxy card or voting instruction card is delivered in accordance with its instructions prior to 11:59pm, Eastern Time, on December 14, 2023. Stockholder may submit proxies by completing, signing, and dating their proxy card and mailing it in the accompanying pre-addressed envelope. |

| ● | By Attending the Meeting: Stockholders may vote in person by attending the Special Meeting. Those stockholders who plan to attend the Special Meeting should refer to “How can I attend and vote at the Special Meeting?” below for further instructions regarding how to vote your shares at the Special Meeting. |

| ● | By Going Online: Stockholders may vote online by following the instructions included in the proxy card they received. Your vote must be received by 11:59 p.m., Eastern Time on December 14, 2023 to be counted. Have your proxy card available when you access the website or when you call. We provide Internet proxy voting to allow you to vote your shares online, with procedures designed to ensure the authenticity and correctness of your proxy vote instructions. However, please be aware that you must bear any costs or usage charges from Internet access providers. |

If you vote by proxy, your vote must be received by 11:59 p.m. U.S. Eastern Standard Time on December 14, 2023, to be counted.

Whichever method you select to transmit your instructions, the proxy holders will vote your shares in accordance with those instructions. If no specific instructions are given, the shares will be voted in accordance with the recommendation of our Board and as the proxy holders may determine in their discretion with respect to any other matters that properly come before the meeting.

How can I attend and vote at the Special Meeting?

In order to be admitted to the Special Meeting, you must bring documentation showing that you owned shares of our common stock as of November 21, 2023, the Record Date. Acceptable documentation includes (i) your proxy statement and (ii) your proxy card. All attendees must also bring valid photo identification. Stockholders who do not bring the requisite documentation will not be admitted to the Special Meeting.

How can I vote if my shares are held in a stock brokerage account, or by a bank or other nominee?

If your shares are held in a stock brokerage account or by a bank or other nominee, you are considered the “beneficial owner” of shares held in “street name,” and your broker or nominee is considered the “stockholder of record” with respect to those shares. Your broker or nominee should be forwarding these proxy materials to you. As the beneficial owner, you have the right to direct your broker, bank, or other nominee how to vote, and you are also invited to attend the Special Meeting. However, since you are not the stockholder of record, you may not vote these shares in person at the Special Meeting, unless you obtain a legal proxy from your brokerage firm or bank. If a broker, bank, or other nominee holds your shares, you will receive instructions from them that you must follow in order to have your shares voted.

What is a quorum for the Special Meeting?

The presence of the holders of stock representing one-third of the voting power of all shares of Common Stock issued and outstanding as of the Record Date is necessary to constitute a quorum for the transaction of business at the Special Meeting. Your shares will be counted towards the quorum only if you submit aa valid proxy (or one is submitted on your behalf by a broker) or if you attend the Special Meeting and vote, in person, at the Special Meeting. Abstentions and broker non-votes will be counted as present for purposes of determining a quorum. Pursuant to the provisions of the Company’s Amended and Restated Bylaws, the holders of one-third of the voting power of the capital stock issued and outstanding and entitled to vote, present in person, or by remote communication, if applicable, or represented by proxy, shall constitute a quorum for the transaction of business at all meetings of the stockholders. Based on there being 10,693,580 shares of our Common Stock outstanding and entitled to vote on the Record Date, the presence, in person or by proxy, of stockholders holding an aggregate of 3,564,527 shares of Common Stock will be required to constitute a quorum for purposes of taking action at the Special Meeting.

What is the voting requirement to approve each of the proposals?

| Proposal | Vote Required | Broker Discretionary Voting Allowed | ||

| No. 1 – Approval of Issuance of More than 20% of our Common Stock in one or more future public offerings | Affirmative vote of a majority of shares present and entitled to vote in person or by proxy | No | ||

| No. 2– Adjourn the Special Meeting to solicit more votes to approve Proposal No. 1 | Affirmative vote of a majority of shares present and entitled to vote in person or by proxy | No |

What is the effect of abstentions and broker non-votes?

Abstentions will have the same effect as an “AGAINST” vote while broker non-votes will not be counted as votes cast and, accordingly, will not have an effect on Proposal Nos. 1 and 2.

If you are a beneficial owner and hold your shares in “street name” in an account at a bank or brokerage firm, it is critical that you cast your vote if you want it to count in the vote on the above proposals. Under the rules governing banks and brokers who submit a proxy card with respect to shares held in “street name,” such banks and brokers have the discretion to vote on routine matters, but not on non-routine matters. There are no routine matters included at the Special Meeting. Banks and brokers may not vote any of the proposals being presented at the Special Meeting if you do not provide specific voting instructions. Accordingly, we encourage you to vote promptly, even if you plan to attend the Special Meeting. In tabulating the voting results for any particular proposal, shares that constitute broker non-votes are not considered entitled to vote on that proposal.

Can I change my vote or revoke my proxy?

Subject to any rules and deadlines your broker, trustee or nominee may have, you may change your proxy instructions at any time before your proxy is voted at the Special Meeting. If you are a stockholder of record, you may change your vote by (1) delivering to the Company’s Corporate Secretary, prior to your shares being voted at the Special Meeting, a written notice of revocation dated later than the prior proxy card relating to the same shares, (2) delivering a valid, later-dated proxy in a timely manner, (3) attending the Special Meeting and voting electronically (although attendance at the Special Meeting will not, by itself, revoke a proxy), or (4) voting again via the Internet at a later date.

If you are a beneficial owner of shares held in street name, you may change your vote (1) by submitting new voting instructions to your broker, trustee or other nominee, or (2) if you have obtained a legal proxy from the broker, trustee or other nominee that holds your shares giving you the right to vote the shares and provided a copy to our transfer agent and registrar, Philadelphia Stock Transfer, Inc., together with your email address as described below, by attending the Special Meeting and voting the shares at the Special Meeting.

Any written notice of revocation or subsequent proxy card must be received by the Company’s Corporate Secretary prior to the taking of the vote at the Special Meeting.

Who will bear the cost of soliciting votes for the Special Meeting?

The Company will bear the cost of preparing, assembling, printing, mailing, and distributing these proxy materials and soliciting votes. If you access the proxy materials over the Internet, you are responsible for Internet access charges you may incur. In addition, we will request banks, brokers and other intermediaries holding shares of our Common Stock beneficially owned by others to obtain proxies from the beneficial owners and will reimburse them for their reasonable expenses in so doing. Solicitation of proxies by mail may be supplemented by electronic communications and personal solicitation by our Executive Officers, Directors, and employees. No additional compensation will be paid to our Executive Officers, Directors or employees for such solicitation.

Proxies with respect to the Special Meeting may be solicited by mail on the Internet or in person.

Who Can Answer Your Questions About Voting Your Shares?

If you are a holder of the Company’s shares and have any questions about how to vote or direct a vote in respect of your securities, you may call Shaun R. Bagai, Telephone: (650) 284-4433.

PROPOSAL NO. 1

APPROVAL OF ISSUANCE OF SECURITIES IN ONE OR MORE NON-PUBLIC OFFERINGS

Our common stock is currently listed on the Nasdaq Capital Market and, as such, we are subject to Nasdaq Marketplace Rules. Nasdaq Marketplace Rule 5635(d) (“Rule 5635(d)”) requires us to obtain stockholder approval prior to the issuance of our common stock in connection with certain non-public offerings involving the sale, issuance or potential issuance by the Company of common stock (and/or securities convertible into or exercisable for common stock) equal to 20% or more of the common stock outstanding immediately prior to entering into an agreement in connection with any such non-public offering.

Need to Raise Additional Capital

We currently need to raise additional capital to fund our operations, implement our business strategy and enhance our overall capitalization. While we have not yet determined the particular terms for any potential financing, we are currently in discussions with certain parties in connection with such potential financing. Because we may seek additional capital in non-public offerings that would result in the issuance of shares of our common stock equal to or in excess of 20% of the number of shares of our common outstanding immediately prior to entering into an agreement for such potential financing, and which would trigger the requirement to obtain stockholder approval, pursuant to Rule 5635(d), we are seeking stockholder approval now, so that we will be able to move quickly to take full advantage of any opportunities that may develop for us to raise such capital.

We hereby submit this Proposal 1 to our stockholders for their approval of the potential issuance of shares of our common stock, or securities convertible into our common stock, in one or more non-public capital-raising transactions, or offerings, subject to the following limitations:

| ● | The aggregate number of shares of our common stock issued in the offerings will not exceed 40,000,000 shares of our common stock, which may be issued in any combination of common stock and/or equity linked securities, subject to adjustment for any reverse stock split of our shares of common stock (a “Reverse Stock Split”) effected prior to the offerings;

|

| ● | The total aggregate consideration will not exceed $15 million;

|

| ● | The maximum discount at which securities will be offered (which may consist of a share of common stock and a warrant exercisable for the issuance of up to an additional share of common stock) will be equivalent to a discount of up to 10% below the market price of our common stock at the time of issuance in recognition of the historical volatility making the pricing discount of our stock required by investors at any particular time difficult, at this time, to predict.

|

| ● | Such offerings will occur, if at all, on or before January 15, 2024, unless extended up to an additional 30 days in our sole discretion; and

|

| ● | Such other terms as the Board of Directors shall deem to be in the best interests of the Company and its stockholders, not inconsistent with the foregoing. |

Notwithstanding the foregoing, we will not sell securities to any officers, directors, or employees of the Company, or any consultants who perform services for the Company, in any such non-public capital-raising transactions or offerings, at a price that is less than the lower of (i) the Nasdaq Official Closing Price (as reflected on Nasdaq.com) immediately preceding the signing of a binding agreement, in connection with such capital-raising transactions or offerings or (ii) the average Nasdaq Official Closing Price of the common stock (as reflected on Nasdaq.com) for the five trading days immediately preceding the signing of a binding agreement, in connection with such capital-raising transactions or offerings.

The issuance of shares of our common stock, or other securities convertible into shares of our common stock, in accordance with any of such non-public offerings would dilute, and thereby reduce, each existing stockholder’s proportionate ownership in our common stock. The stockholders do not have preemptive rights to subscribe to additional shares that may be issued by the Company in order to maintain their proportionate ownership of the common stock.

The issuance of shares of common stock in one or more non-public offerings could have an anti-takeover effect. Such issuance could dilute the voting power of a person seeking control of the Company, thereby deterring or rendering more difficult a merger, tender offer, proxy contest or an extraordinary corporate transaction opposed by the Company.

The Board of Directors has not yet determined the terms and conditions of any potential financings. As a result, the level of potential dilution cannot be determined at this time, but as discussed above, we may not issue more than 40,000,000 shares of our common stock in the aggregate pursuant to the authority requested from stockholders under this proposal, subject to adjustment for any Reverse Stock Split. It is possible that if we conduct a non-public stock offering, some of the shares we sell could be purchased by one or more investors who could acquire a large block of our common stock. This would concentrate voting power in the hands of a few stockholders who could exercise greater influence on our operations or the outcome of matters put to a vote of stockholders in the future.

We cannot determine what the actual net proceeds of the offerings will be until they are completed, but as discussed above, the aggregate dollar amount of the non-public offerings will be no more than $15 million. If all or part of the offerings are completed, the net proceeds will be used for general corporate purposes. We currently have no arrangements or understandings regarding any specific transaction with investors, so we cannot predict whether we will be successful should we seek to raise capital through any offerings.

Why Approval is Needed

Shares of our common stock issuable upon the exercise or conversion of warrants, options, debt instruments or other equity securities issued or granted in any such non-public offerings will be considered shares issued in such a transaction in determining whether the 20% limit has been reached, and, therefore, it is likely that we will need to issue shares of common stock equal to or exceeding 20% of the number of shares of common stock outstanding immediately prior to entering into an agreement for such non-public offering, to be able to raise the capital we require. Accordingly, we seek your approval of Proposal No. 1 in order to satisfy the requirements of Rule 5635(d) in such event.

Effect of Failure to Obtain Stockholder Approval

If the stockholders do not approve this Proposal 1 at the Special Meeting, we could be unable to obtain sufficient financing to fund our operations, implement our business strategy and enhance our overall capitalization. As a result, we would need to seek alternative sources of financing, where stockholder approval is not required, in order to obtain the necessary funds. Any such alternative sources of financing may not be available to us or may not be available on commercially reasonable terms.

No Appraisal Rights

Under the Delaware General Corporation Law, our stockholders are not entitled to appraisal rights with respect to the issuance of securities in one or more non-public offerings, and we will not independently provide our stockholders with any such rights.

Vote Required

The affirmative vote of a majority of the votes cast for this proposal is required to approve the issuance of securities in one or more non-public offerings, as required by and in accordance with Nasdaq Marketplace Rule 5635(d).

Board Recommendation

The Board of Directors recommends a vote FOR the approval of the Equity Issuance Proposal (Proposal 1).

|

PLEASE NOTE: If your shares are held in street name, your broker, bank, custodian or other nominee holder cannot vote your shares for Proposal No. 1, unless you direct the holder how to vote, by marking your proxy card, or by following the instructions on the enclosed proxy card to vote on the Internet.

PROPOSAL NO. 2

THE ADJOURNMENT PROPOSAL

Overview

Proposal No. 2 (the “Adjournment Proposal”), if adopted, will allow the Board to adjourn the Special Meeting to a later date or dates to permit further solicitation of proxies. The Adjournment Proposal will only be presented to the Company’s stockholders, in the event that, notwithstanding management’s having used commercially reasonable efforts to obtain the approval of the stockholders to Proposal No. 1, based upon the tabulated vote at the time of the Special Meeting there are insufficient votes for, or otherwise in connection with, the approval of Proposal No. 1.

Consequences if the Adjournment Proposal is Not Approved

If the Adjournment Proposal is not approved by the stockholders, the Board may not be able to adjourn the Special Meeting to a later date in the event that there are insufficient votes for, or otherwise in connection with, the approval of Proposal No. 1.

Vote Required for Approval

The approval of Proposal No. 2 requires the affirmative vote of holders of a majority of the shares of Common Stock having voting power present in person or represented by proxy at the Special Meeting. Abstentions have the effect of a vote “AGAINST” Proposal No. 2 and broker “non-votes” will have no effect with respect to the approval of the Proposal No. 2.

Board Recommendation

The Board of Directors recommends a vote FOR the approval of Proposal 2.

|

PLEASE NOTE: If your shares are held in street name, your broker, bank, custodian, or other nominee holder cannot vote your shares for Proposal No. 2, unless you direct the holder how to vote, by marking your proxy card, or by following the instructions on the enclosed proxy card to vote on the Internet.

OTHER INFORMATION

Important Notice Regarding Delivery of Stockholder Documents

If your shares are held in street name, your broker, bank, custodian, or other nominee holder may, upon request, deliver only one copy of this proxy statement to stockholders to multiple stockholders sharing an address, absent contrary instructions from one or more of the stockholders. The Company will, upon request, deliver a separate copy of the proxy materials to a stockholder at a shared address to which a single copy was delivered, upon written or oral request, to Corporate Secretary, RenovoRx, Inc., 4546 El Camino Real, Suite B1, Los Altos, CA 94022. Stockholders sharing an address and receiving multiple copies of the proxy materials who wish to receive a single copy should contact their broker, bank, custodian, or other nominee holder.

| By Order of the Board of Directors, | |

| /s/ Shaun Bagai | |

| Shaun R. Bagai | |

| Chief Executive Officer | |

| November 27, 2023 |