UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the fiscal year ended | |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ______to ______ |

Commission

File Number:

(Exact name of registrant as specified in its charter)

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

(Address of principal executive offices, including zip code)

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| The

|

Securities registered pursuant to Section 12(g) of the Act: None

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

Indicate

by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2)

has been subject to such filing requirements for the past 90 days.

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule

405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant

was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ |

| Smaller

reporting company | |

| Emerging

growth company |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate

by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness

of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered

public accounting firm that prepared or issued its audit report.

If

securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant

included in the filing reflect correction of an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No

The

aggregate market value of the voting and non-voting common equity held by non-affiliates on June 30, 2023, the last business

day of the registrant’s most recently completed second fiscal quarter, based upon the closing price of the registrant’s common

stock on such date as reported by The Nasdaq Capital Market, was approximately $

The number of outstanding shares of the registrant’s common stock, $0.0001 par value per share, as of March 25, 2024, was .

DOCUMENTS INCORPORATED BY REFERENCE

RENOVORX, INC. FORM 10-K

TABLE OF CONTENTS

Solely for convenience, trademarks and trade names referred to in this Report may appear without the ® or ™ symbols.

| i |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K, or Form 10-K (this “Report”), particularly in the sections captioned “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Business,” contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), that are based on our management’s beliefs and assumptions and on information currently available to our management. Forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified. All statements other than present and historical facts and conditions contained in this Report, including statements regarding our future results of operations and financial position, business strategy, plans and our objectives for future operations, are forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as “anticipate,” “believe,” “can,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “objective,” “ongoing,” “plan,” “potential,” “predict,” “project,” “should,” “will,” or “would,” or the negative of these terms or other comparable terminology. Actual events or results may differ from those expressed in these forward-looking statements, and these differences may be material and adverse. Forward-looking statements include, but are not limited to, statements about:

| ● | the sufficiency of our existing cash, cash equivalents, and investments to fund our future operating expenses and capital expenditure requirements; | |

| ● | our estimates regarding expenses, future revenue, anticipated capital requirements to fund our future operating expenses, and our need for additional financing; | |

| ● | our financial performance; | |

| ● | our anticipated use of our existing cash, cash equivalents, and investments; | |

| ● | the ability of our clinical trials to demonstrate safety and efficacy of our product candidates, and other positive results; | |

| ● | the progress and focus of our current and future clinical trials, and the timing of reporting of data from those trials; | |

| ● | our continued reliance on third parties to conduct clinical trials of our product candidates, and for the manufacture of our product candidates; | |

| ● | the beneficial characteristics, safety, efficacy, and therapeutic effects of our product candidates; | |

| ● | our ability to advance product candidates into and successfully complete clinical trials; | |

| ● | our ability to further develop and expand our therapy platform, both to use different chemotherapeutic agents, to include new indications, or to market our catheter on a standalone basis; | |

| ● | enrollment timing and projections for our clinical trials and our expectations relating to the timing of the provision of updates on, data readouts for, and completion of our clinical trials; | |

| ● | our ability to obtain and maintain regulatory approval of our product candidates and the timing or likelihood of regulatory filings and approvals, including our expectation to seek special designations, such as orphan drug designation, for our product candidates for various diseases; | |

| ● | existing regulations and regulatory developments in the United States and other jurisdictions; | |

| ● | our plans relating to commercializing our product candidates, if approved, including the geographic areas of focus and our potential and ability to successfully commercialize our product candidates and generate revenue; | |

| ● | the implementation of our strategic plans for our business and product candidates; | |

| ● | the expected potential benefits of strategic collaborations with third parties and our ability to attract collaborators with relevant and complementary expertise; | |

| ● | our estimates of the number of patients in the United States who suffer from the diseases we target; | |

| ● | our estimates of potential market opportunities and our ability to successfully realize these opportunities; |

| ii |

| ● | the success of competing therapies that are or may become available; | |

| ● | developments relating to our competitors and our industry, including competing product candidates and therapies; | |

| ● | our plans relating to the further development and manufacturing of our product candidates, including for additional indications which we may pursue; | |

| ● | our plans and ability to obtain or protect intellectual property rights, including extensions of existing patent terms where available; | |

| ● | the scope of protection we are able to establish and maintain for intellectual property rights, including our therapy platform and product candidates; | |

| ● | our ability to successfully negotiate and enter into agreements with distribution, strategic and corporate partners; | |

| ● | our potential and ability to successfully manufacture and supply our product candidates for clinical trials and for commercial use, if approved; | |

| ● | our ability to retain the continued service of our key personnel and to identify, hire, and then retain additional qualified personnel; | |

| ● | our ability to maintain compliance with the continuing listing requirements of the Nasdaq Stock Market; and | |

| ● | our expectations regarding the impact of major domestic and geopolitical events on our business. |

We have based the forward-looking statements contained in this Report primarily on our current expectations and projections about future events and trends that we believe may affect our business, financial condition, results of operations, prospects, business strategy and financial needs. The outcome of the events described in these forward-looking statements is subject to risks, uncertainties, assumptions and other factors described in the section titled “Risk Factors” and elsewhere in this Report. These risks are not exhaustive. Other sections of this Report include additional factors that could adversely affect our business and financial performance. Moreover, we operate in a very competitive and rapidly changing environment. New risks and uncertainties emerge from time to time and it is not possible for us to predict all risks and uncertainties that could have an impact on the forward-looking statements contained in this Report. We cannot assure you that the results, events and circumstances reflected in the forward-looking statements will be achieved or occur, and actual results, events or circumstances could differ materially from those described in the forward-looking statements. In light of the significant uncertainties in these forward-looking statements, you should not regard these statements as a representation or warranty by us or any other person that we will achieve our objectives and plans in any specified time frame or at all.

In addition, statements that “we believe” and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based upon information available to us as of the date of this Report, and while we believe such information forms a reasonable basis for such statements, such information may be limited or incomplete, and our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all potentially available relevant information. These statements are inherently uncertain and investors are cautioned not to unduly rely upon these statements.

The forward-looking statements made in this Report relate only to events as of the date on which such statements are made. We undertake no obligation to update any forward-looking statements after the date of this Report or to conform such statements to actual results or revised expectations, except as required by law. Unless the context otherwise indicates, “RenovoRx,” the “Company,” “we,” “our,” and “us” refer to RenovoRx, Inc., a Delaware corporation. All information presented herein is based on our fiscal calendar. Unless otherwise stated, references to particular years, quarters, months or periods refer to the Company’s fiscal years ended in December and the associated quarters, months and periods of those fiscal years.

This Report contains market data and industry forecasts that were obtained from industry publications. These data and forecasts involve a number of assumptions and limitations, and you are cautioned not to give undue weight to such information. We have not independently verified any third-party information. While we believe the market position, market opportunity and market size information included in this Report is generally reliable, such information is inherently imprecise.

| iii |

PART I

ITEM 1. BUSINESS

Overview

We are a clinical-stage biopharmaceutical company developing proprietary targeted combination therapies for high unmet medical needs with a goal to improve therapeutic outcomes for cancer patients undergoing treatment. Our proprietary Trans-Arterial Micro-Perfusion (TAMPTM) therapy platform is designed to ensure precise therapeutic delivery to directly target the tumor while potentially minimizing a therapy’s toxicities versus systemic (intravenous (known as “IV”) therapy).

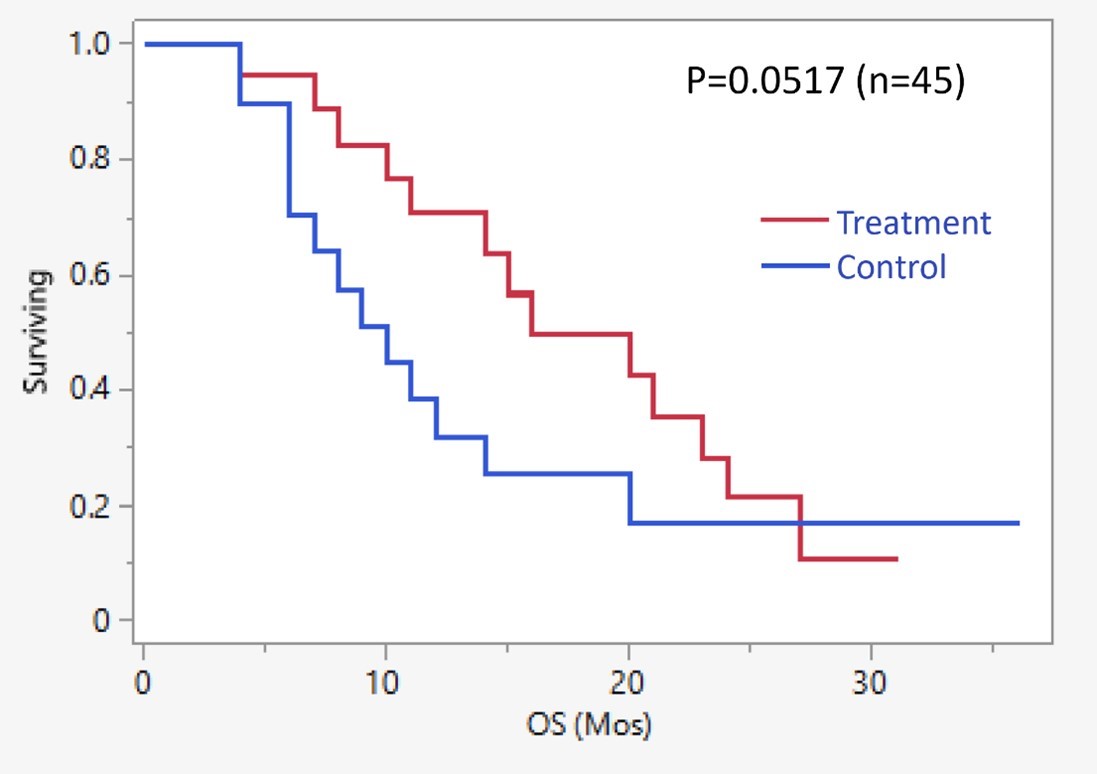

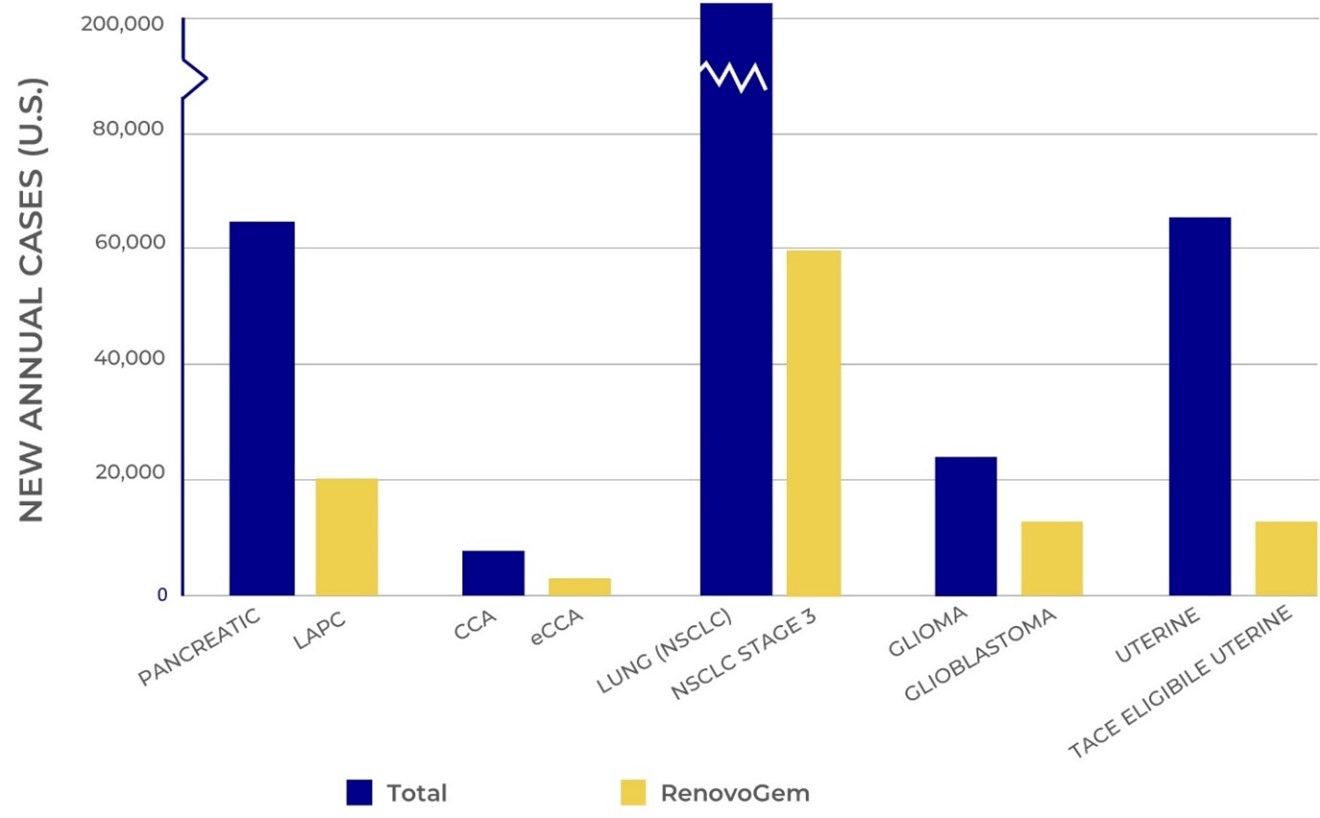

Our novel and patented approach to targeted treatment offers the potential for increased safety, tolerance, and improved efficacy. Our Phase III lead product candidate, RenovoGemTM, an oncology drug-device combination product, is being investigated under a U.S. Investigational New Drug Application (“IND”) that is regulated by the U.S. Food and Drug Application (“FDA”) 21 CFR 312 pathway. RenovoGem is currently being evaluated for the treatment of locally advanced pancreatic cancer (“LAPC”) by the Center for Drug Evaluation and Research (the drug division of FDA). We also plan to evaluate RenovoGem as a potential therapy in bile duct cancer with other potential pipeline indication opportunities to follow including non-small cell lung cancer, uterine tumors, glioblastoma, and sarcoma.

RenovoGem received FDA Orphan Drug Designation for pancreatic cancer and bile duct cancer, which provides 7 years of market exclusivity upon approval by the FDA of our New Drug Application (“NDA”) for RenovoGem Should such approval be obtained.

We have completed our RR1 Phase I/II and RR2 observational registry studies of RenovoGem, with 20 and 25 patients respectively, in LAPC. These studies demonstrated a median Overall Survival (known as “OS”) of 27.9 months in LAPC patients pre-treated with radiation followed by treatment with RenovoGem. Based on previous large randomized clinical trials, the expected survival of LAPC patients is 12 to 15 months in patients receiving only IV systemic chemotherapy or IV chemotherapy plus radiation (which are both considered standard of care). Unlike the randomized trials that established these standard of care results, our RR1 and RR2 clinical trials did not prospectively control the standard of care therapy received prior to administration of RenovoGem. Based on an FDA safety review of our Phase I/II study, FDA allowed us to proceed to evaluate RenovoGem within our Phase III registrational clinical trial, which is ongoing as described below.

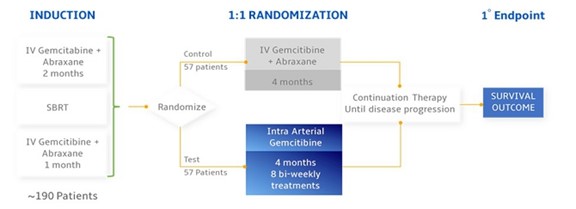

Our Phase III registrational trial of RenovoGem for the treatment of LAPC is called TIGeR-PaC. This clinical trial is an ongoing randomized multi-center study using TAMP to evaluate RenovoGem. The study is evaluating trans-arterial delivery, a form of intra-arterial (“IA”) administration, of an FDA-approved chemotherapy, gemcitabine, to treat LAPC following stereotactic body radiation therapy (“SBRT”). The study is comparing treatment of an FDA-approved cancer drug, gemcitabine, with TAMP versus systemic IV administration of gemcitabine and nab-paclitaxel.

Our protocol for TIGeR-PaC involves systemic chemotherapy and only SBRT during the induction phase of the study (prior to randomization). Patients receiving SBRT during the induction phase are required to complete 5 treatments, over 5 consecutive days, and do not receive oral chemotherapy vs. previously utilized intensity-modulated radiation therapy (IMRT) where patients must complete 25 radiation treatments in combination with oral chemotherapy during the induction phase of the study, which takes between 35 and 56 days to complete. In December 2021, we amended our protocol and statistical analysis plan for TIGeR-PaC (the “Modified SAP”) to (i) analyze only patients receiving SBRT during the induction phase, (ii) include a second interim analysis, (iii) change the total number of patients randomized in the study to 114 with a total of 86 deaths from SBRT patients, and (iv) repower the study from 90% to 80%, which is commonly used in clinical trials. We believe this design will shorten the timeframe needed to complete the study and also significantly decrease our costs. We have not discussed the protocol amendment or the Modified SAP with the FDA, and we cannot provide any assurance that the FDA will agree with these modifications, but these modifications have been submitted to the FDA.

| 1 |

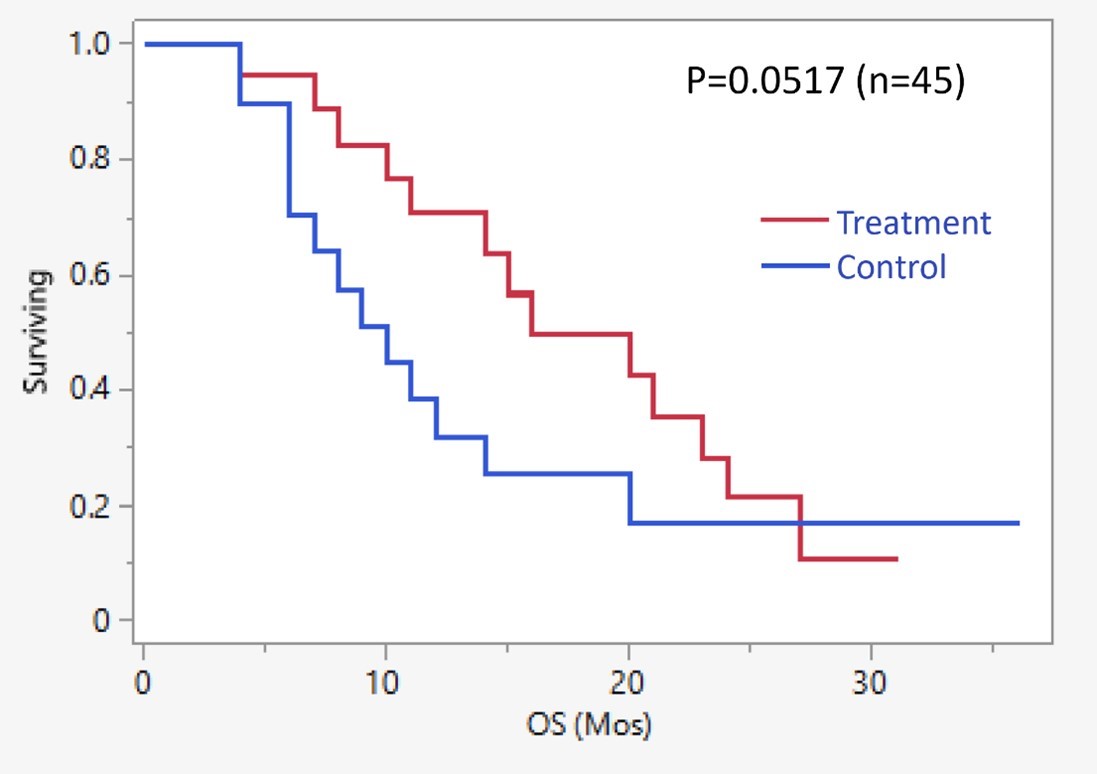

The first interim analysis in the TIGeR-PaC study at the 26th event of the specified events (deaths), was completed in March 2023, with the Data Monitoring Committee recommending a continuation of the study. The TIGeR-PaC study’s primary endpoint is a 6-month OS benefit with secondary endpoints including reduced side effects versus standard of care. The data was first presented at the 2023 American Association for Cancer Research Annual Meeting in April 2023 and then as a Late Breaker Oral Presentation with additional secondary endpoint data at the 2023 European Society of Medical Oncology World Congress on Gastrointestinal Cancer in June 2023. The second interim analysis for this study will be triggered by the 52nd event (death of patient), which is estimated to occur in late 2024. The second interim data read out would follow thereafter, with the timing for such read out depending on customary factors such as time needed for analysis.

Our TAMP therapy platform is focused on optimizing drug concentration in solid tumors using approved small molecule chemotherapeutics. Our platform enables physicians to isolate segments of the vascular anatomy closest to tumors and force chemotherapy across the blood vessel wall to bathe these difficult-to-reach solid tumors in chemotherapy. Specifically, our patented approach allows physicians to combine, on the one hand, pre-treatment of the local blood vessels and tissue with standard-of-care radiation therapy to decrease chemotherapy washout and, on the other hand, local delivery via our patented RenovoCath delivery system which utilizes pressure to force small molecule chemotherapy into the tumor tissue. We believe there are many advantages to our TAMP therapy platform, including:

| ● | Application of Approved Small Molecule Chemotherapeutic Agents: To date have used approved small molecule chemotherapeutic agents, such as gemcitabine, with well-known safety and efficacy profiles. | |

| ● | Targeted Approach: In a preclinical study using our therapy platform, we demonstrated up to 100 times higher local drug concentration compared to systemic chemotherapy. We believe our TAMP therapy platform allows for a targeted approach that can decrease systemic exposure and improve patient outcomes. | |

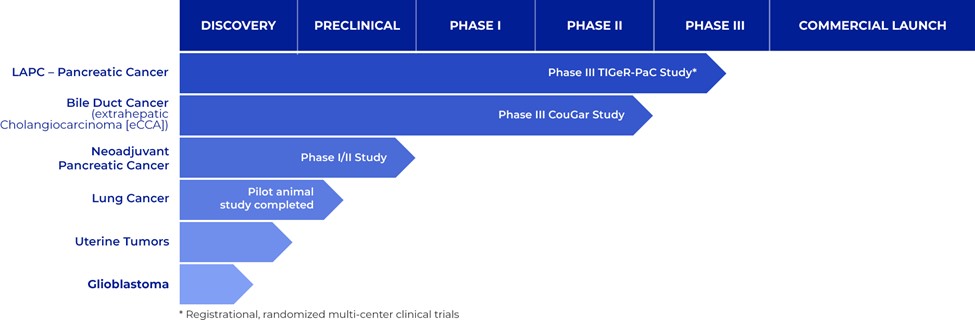

| ● | Delivery Method Independent of Tumor Vascularity: Our therapy platform is designed to deliver therapy to solid tumors resistant to systemic therapy due to lack of tumor feeder blood vessels. If approved, our product candidates have the potential to treat tumors that are not directly supported by blood vessels. | |

| ● | Broad Application for Solid Tumor Indications: Our therapy platform is not restricted to a single small molecule chemotherapeutic agent or solid tumor type. As such, it may be utilized for delivery of other agents and applied for use in additional solid tumor indications, including in solid tumors without identifiable tumor feeder blood vessels. |

| 2 |

In further validation of our TAMP platform, in July 2023, we announced a collaboration with Imugene (ASX: IMU) to explore expansion of our TAMP product pipeline with Imugene’s CF33 oncolytic virus therapy for the treatment of difficult-to-access tumors. We are constantly in discussions regarding similar collaborations and potentially out-licenses of RenovoGem as we gear up for the RenovoGem NDA filing (assuming we meet our study endpoints) and commercialization of RenovoGem (if approved by FDA) as well as other potential collaborations with our TAMP platform.

Figure 1: Graph showing first interim analysis in the TIGeR-PaC study

Research and Development Pipeline

Our portfolio of cancer therapies is based on our lead product candidate, RenovoGem (gemcitabine delivered via our patented delivery system), regulated by the FDA as a novel oncology drug product. RenovoGem utilizes pressure-mediated delivery of gemcitabine across the arterial wall to bathe tumor tissue in chemotherapy.

Funding permitting, we plan on further evaluating RenovoGem in other cancer indications. Our current pipeline is summarized below:

Figure 2: RenovoGem Clinical Pipeline detailing our potential portfolio of cancer therapies based on our TAMP therapy platform.

Gemcitabine has been considered a standard of care drug for several solid tumors, and the drug’s anti-cancer tumor effects are well profiled. Our TAMP platform therapy utilizes pressure mediated delivery of gemcitabine across the arterial wall to bathe the pancreatic tumor tissue in 120 mL of saline with 1,000 mg/m2 of the drug over a 20-minute delivery period (delivering 1,500-2,000 mg of drug depending upon patient body surface area). Our delivery system, RenovoCath, is a double balloon catheter designed with the capability to isolate sections of the blood vessel through the adjustment of the distance between the balloons, thereby excluding any branching blood vessel offshoots in order to create the pressure head needed to push drug across the blood vessel wall.

| 3 |

We intend to explore applications of our TAMP platform in additional indications, including bile duct cancer, locally advanced lung cancer, locally advanced uterine cancer, and glioblastoma. We have completed and presented data on a lung cancer application in preclinical studies, and additional preclinical experiments in lung cancer may be conducted.

We are using gemcitabine in our initial anti-cancer product candidate, RenovoGem. However, multiple small molecule therapeutics are compatible with our TAMP platform. We intend to opportunistically develop additional anti-cancer product candidates using small molecule therapeutics in combination with our therapy platform.

While the field of oncology has seen progress in treating a handful of deadly cancers over the last few decades, there is a common objective in chemotherapy: enhanced dosing of the drug to impact the tumor while minimizing systemic toxicity. The characteristics of the blood vessels, within and surrounding the tumor, can limit or thwart the achievement of this goal. For example, LAPC and bile duct cancer, known as extrahepatic (or outside the liver) cholangiocarcinoma (“eCCA”) are more difficult to treat due to the lack of blood vessels that feed these tumors, making it difficult to expose tumors to chemotherapy, which is typically delivered intravenously. Trans-arterial chemoembolization (“TACE”) is an established first line therapy for solid tumors. A key component of this approach is to identify and isolate vessels feeding the tumor, known as tumor feeder blood vessels. However, in patients with pancreatic cancer, no tumor feeder blood vessels are visible despite attempts to image them using a variety of modalities. In the absence of visible tumor feeder blood vessels, our therapy platform has the potential to introduce drugs directly across the arterial wall into the surrounding tissue via pressurized diffusion.

RenovoGem in Locally Advanced Pancreatic Cancer (LAPC)

Our protocol for the TIGeR-PaC clinical trial involves systemic chemotherapy and only SBRT during the induction phase of the study (prior to randomization). Patients receiving SBRT during the induction phase are required to complete 5 treatments, over 5 consecutive days, and do not receive oral chemotherapy vs. previously utilized intensity-modulated radiation therapy (“IMRT”) where patients must complete 25 radiation treatments in combination with oral chemotherapy during the induction phase of the study, which takes between 35 and 56 days to complete. In December 2021, we amended the protocol as follows: we plan to (i) analyze only patients receiving SBRT during the induction phase, (ii) include a second interim analysis, (iii) change the total number of patients randomized in the study to 114 with a total of 86 deaths from SBRT patients, and (iv) repower the study from 90% to 80%, which is commonly used in clinical trials. We believe this design will shorten the timeframe needed to complete the study and also significantly decrease our costs. We have not discussed the protocol amendment or the Modified SAP with the FDA, and we cannot provide any assurance that the FDA will agree with these modifications, but these modifications have been submitted to the FDA.

The first interim analysis in the TIGeR-PaC study at the 26th event of the specified events (deaths), was completed in March 2023, with the Data Monitoring Committee recommending a continuation of the study. The TIGeR-PaC study’s primary endpoint is a 6-month OS benefit with secondary endpoints including reduced side effects versus standard of care. The data was first presented at the 2023 American Association for Cancer Research Annual Meeting in April 2023 and then as a Late Breaker Oral Presentation with additional secondary endpoint data at the 2023 European Society of Medical Oncology World Congress on Gastrointestinal Cancer in June 2023. The second interim analysis for this study is expected to occur at the 52nd event which is estimated to occur in late 2024.

RenovoGem in eCCA and Other Potential Clinical Indications

Funding permitting, we also plan to evaluate RenovoGem as a potential therapy in bile duct cancer with other potential pipeline indication opportunities to follow including non-small cell lung cancer, uterine tumors, glioblastoma, and sarcoma.

After significant input from key opinion leaders across the spectrum of relevant medical specialties and feedback from the FDA, we submitted the protocol for a Phase II/III eCCA clinical trial to FDA, and after receiving feedback, we are finalizing the protocol and also including incorporating a recently approved drug, durvalumab into the study protocol with guidance from the Steering Committee. We anticipate launching this study mid-2024. We have also secured FDA Orphan Drug Designation for RenovoGem for the treatment of cholangiocarcinoma, which would provide us with seven years of orphan exclusivity to market RenovoGem for our eCCA indication upon NDA approval, provided that we are the first sponsor to obtain FDA approval for IA gemcitabine for the eCCA indication.

| 4 |

Our Team

Our management team, Board of Directors, and Scientific Advisors provide us with expertise across multiple sectors to drive success through clinical development and subsequent commercialization of our novel therapy platform. Our Chief Executive Officer, Shaun Bagai, gained extensive experience running clinical trials and launching, creating, and developing new markets for novel therapies at TransVascular, Medtronic, Ardian, and HeartFlow. Dr. Ramtin Agah, our Co-Founder and Chief Medical Officer, is a practicing cardiovascular specialist who has 20 years of research experience in vascular biology and disease in both academia and industry. Leesa Gentry, our Chief Clinical Officer, with 29 years of experience focused on improving clinical research programs in Contract Research Organization (CRO), pharmaceutical, and biotech industries. Past employers include IQVIA (Quintiles), PPD, OmnicareCR and Otsuka. Prior to RenovoRx, she was Senior Vice President (SVP) of Clinical Operations at Evotec. Our Board of Directors includes a wide range of public and private company management, board and life sciences experience, including drug/device combination and oncology experience. Clinical advisors include experts across many specialties who treat solid tumors. Dr. Margaret Tempero is Professor of Medicine, Division of Hematology and Oncology, at UCSF. She also serves as Chair of the NCCN Guidelines Panel on Pancreatic Cancer (since 2000), editor-in-chief of JNCCN, and on the ASCO Conquer Cancer Foundation Board. Previously, Dr. Tempero has served on the ASCO Board of Directors, as ASCO President, and as a member of FDA’s Oncology Drug Advisory Committee. Dr. Michel Ducreux is the Head of the Gastrointestinal Oncology Unit and Gastrointestinal Oncology Tumor Board at Gustave Roussy, Professor of Oncology at Paris-Saclay University in France, and Vice-Chair of ESMO GI. Dr. Michael Pishvaian, a medical oncologist, has extensive experience running oncology studies and is an Associate Professor, and Director of the Gastrointestinal, Developmental Therapeutics, and Clinical Research Programs at the NCR Kimmel Cancer Center at Sibley Memorial Hospital Johns Hopkins University School of Medicine. Dr. Pishvaian is the Principal Investigator / Global Study Chair of our TIGeR-PaC Phase III study. Dr. Karyn Goodman serves as the Radiation Monitor for our TIGeR-PaC Phase III study and Professor and Vice Chair of Clinical Research, Department of Radiation Oncology at the Icahn School of Medicine at Mount Sinai, and Associate Director of Clinical Research at the Tisch Cancer Institute at Mount Sinai.

Current Treatments and Limitations of Approaches

Currently, solid tumors are typically treated using one or a combination of treatment modalities: surgery, radiation, and pharmacological therapies (chemotherapy). For solid tumors, when possible, surgical resection of the tumor is the most frequently employed treatment approach. If the tumor is detected at an early stage and is localized to the affected organ, surgical removal of the entire tumor may be an effective and potentially curative treatment. In most cases, surgery is undertaken and / or completed prior to commencing additional treatment approaches. However, multiple solid tumor types, including LAPC and eCCA are diagnosed at advanced stages, which precludes surgery as a treatment approach. In many of these circumstances, the tumor has grown into adjacent anatomical structures making surgery difficult or impossible.

IV, also known as systemic, chemotherapy (gemcitabine and nab-paclitaxel), which has a seven-week survival benefit over IV gemcitabine alone, is considered standard of care for most solid tumors, but limitations include less than acceptable efficacy, systemic toxicities, and other side effects.

For the treatment of some localized solid tumors, TACE is an established first line therapy. Many companies have developed therapeutic products for use in this approach to treat tumors of the liver, uterus, and prostate. Many solid tumors have a dedicated blood supply: small blood vessels, called tumor feeder blood vessels, that branch off of larger native arteries and terminate in the tumors to provide nutrition to the tumors. A key aspect of TACE is to identify and isolate these tumor feeder blood vessels during x-ray angiography and then deliver the desired therapy including chemotherapy and embolic agents. In patients with LAPC, no tumor feeder blood vessels are visible during angiography due to the avascular (lack of blood vessels) nature of these tumors. This limitation has rendered TACE ineffective in the treatment of patients with LAPC, eCCA, and a subset of other solid tumors. The limitations of TACE translate to low survival rates in these tumor subtypes. The use of TACE with or without immuno-oncology treatment approaches, which harness the body’s immune system to treat cancer, has not significantly improved survival rates in these subtypes. For example, due to the inability of immune cells to penetrate the tumor tissue, early studies of targeted immunotherapies in pancreatic cancer have demonstrated limited success.

| 5 |

Our Platform: TAMP

TAMP may work best with avascular tumors

Certain tumor types are sufficiently vascularized (i.e., tumors with blood vessels associated with them) to enable use of systemic chemotherapy and standard of care local therapy techniques. In Figure 3 below, for example, the panel on the left depicts visualization of an actual tumor, hepatocellular carcinoma (“HCC”), or primary liver cancer, under x-ray angiography as dye injected through the arteries reaches the tumor itself. Further, visible tumor feeder blood vessels can be reached by simple end-hole catheters to deliver targeted therapy to these liver tumors. In contrast, the panel on the right illustrates the typical lack of tumor feeder blood vessels to a pancreatic tumor. Given the lack of tumor feeder blood vessels, the dye does not reach the tumor, rendering the tumor “invisible” under x-ray angiography.

Figure 3: Showing liver tumors that are highly vascularized, and pancreatic tumors that are avascular.

TAMP has been under development for over 14 years

In 2009, our founder Dr. Ramtin Agah, an experienced interventional cardiologist with a degree in biomedical engineering, developed the concept for TAMP as a way to deliver chemotherapy locally to treat poorly vascularized tumors. He joined forces with Kamran Najmabadi, who brought significant medical device engineering experience, to found RenovoRx in 2009. Subsequently, we engaged a contract manufacturer to prototype and manufacture our RenovoCath delivery devices. We received our first FDA 510(k) clearance for RenovoCath in 2014, a second clearance to use the RenovoCath for infusion of chemotherapy agents in 2017, a further clearance to use RenovoCath with a power-injector in 2019, and a fourth clearance in 2021 to expand vessel diameter range to 3-11mm, implement certain changes in the Instructions for Use, change the recommended saline to contrast solution ratio, among other changes and improvements. RenovoCath is intended for the isolation of blood flow and delivery of fluids, including diagnostic and/or therapeutic agents, to selected sites in the peripheral vascular system. RenovoCath is also indicated for temporary vessel occlusion in applications including arteriography, preoperative occlusion, and chemotherapeutic drug infusion. RenovoCath is intended for general intravascular use in the peripheral vasculature in arteries 3 mm and larger as well as for use in arteries from 3 mm in diameter for vessel entry and to occlude vessels ranging between 3 mm to 11 mm in diameter. We are evaluating our lead product candidate RenovoGem under an IND filed in 2018. FDA has determined that RenovoGem will be regulated as, and if approved we expect will be reimbursed as, a new oncology drug product.

| 6 |

How it works: we developed TAMP as an attempt to solve the problems of treating avascular tumors

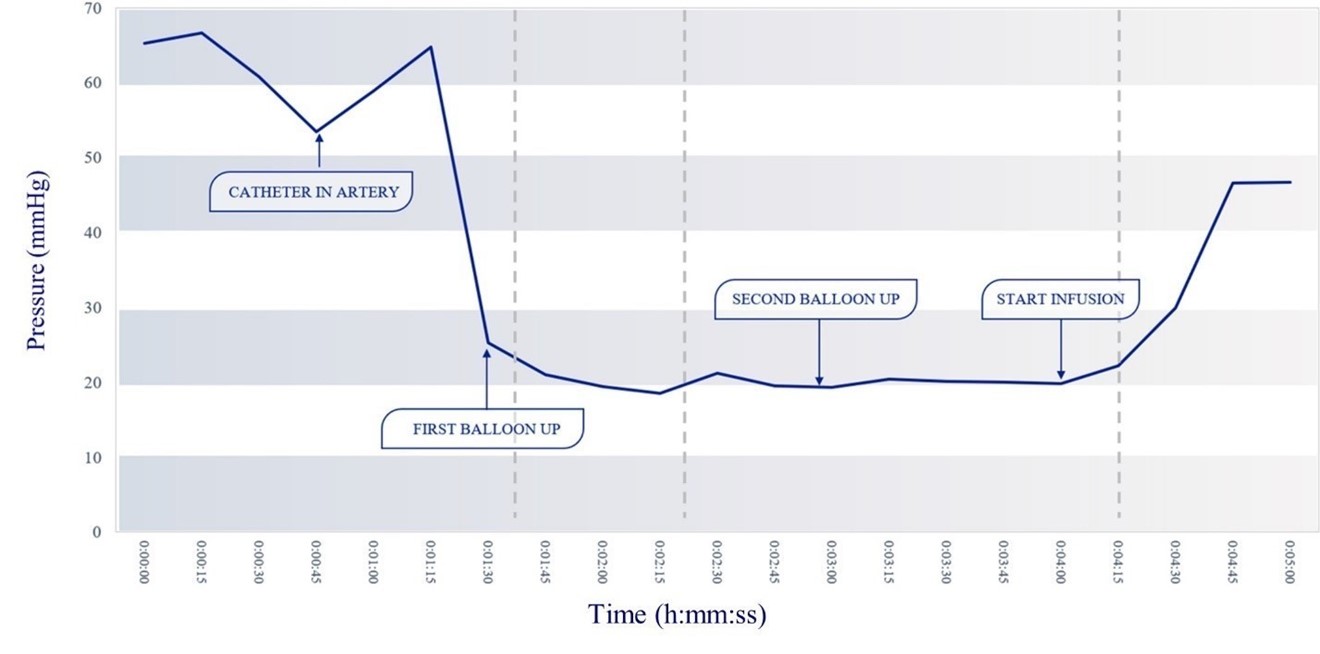

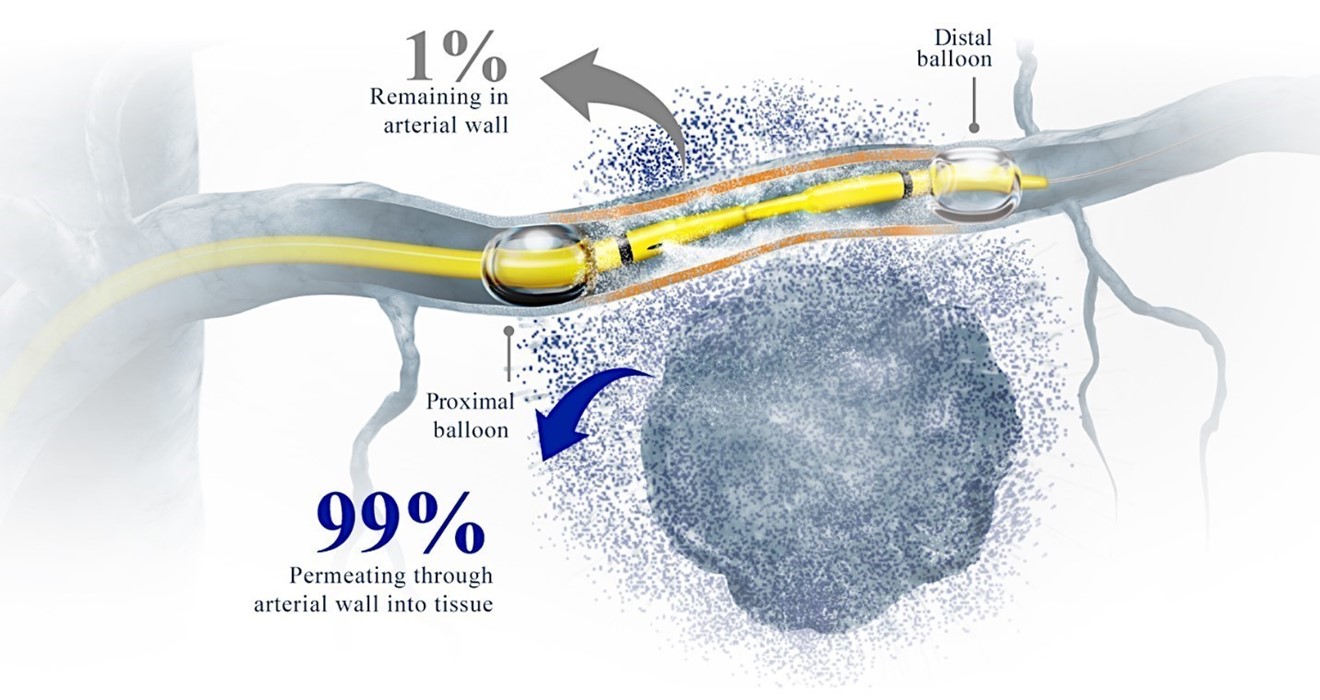

To overcome the limitations resulting from a lack of tumor feeder blood vessels, we explored a different approach to locally deliver anti-cancer drugs. By isolating a section of the blood vessel and then increasing the intravascular pressure in the isolated segment, we can introduce chemotherapy directly across the arterial wall into the surrounding tissue via pressurized diffusion, which we call Trans-Arterial Micro-Perfusion (for the acronym TAMP). To isolate the vessel and create this pressure gradient, we developed RenovoCath, a patented adjustable double balloon catheter to occlude the proximal and distal part of the vessel. Using the TAMP technique in explanted (dissected out of the animal and used separately in a saline water bath) pig aorta and iliac arteries (peripheral arteries that carry blood to the legs, reproductive organs and pelvis), we were able to validate our hypothesis by demonstrating >99% gemcitabine pressurized diffusion across the arterial wall in the absence of feeder vessels. This mechanism of action was further supported by exploratory acute animal studies measuring the pressure gradient within the artery during double balloon occlusion. Figure 4 demonstrates the change in IA pressure over time from catheter introduction to balloon inflation, start of infusion, and pressure plateau when chemotherapy is forced out of vessel. These changes in pressure are a result of pressure declining as the first balloon blocks blood inflow and then rising as the drug is administered and fills up the space between the balloons.

Figure 4: Occluding the vessel with RenovoCath, while adjusting the balloon-to-balloon distance to exclude all blood vessel branches, established an intravascular interstitial pressure in the isolated blood vessel segment of approximately 20 mmHg. With subsequent infusion of fluids between the balloons at 6 mls/minute, the intravascular pressure increases to above 45 mmHg, trans-arterially forcing the small molecule drug across the arterial wall via diffusion (this patented process of perfusing the vessel wall is Trans Arterial Micro Perfusion or TAMP).

Our TAMP platform therapy utilizes pressure mediated delivery of gemcitabine across the arterial wall to bathe the pancreatic tumor tissue in 120 mL of saline with 1,000 mg/m2 of drug over a 20-minute delivery period (delivering 1,500 - 2,000 mg of drug depending upon patient body surface area. This blanketing approach of large fluid volume delivery over time may enable the drug to approach these difficult-to-reach tumors.

We believe some of the key advantages of TAMP include:

| ● | It is ideal for solid tumors where resection is not possible due to proximity/impingement of tumor on blood vessels, nerves, or other key structures | |

| ● | No need for identifying tumor feeder blood vessels to deliver the drug. These generally do not exist in avascular or hypovascular tumors such as LAPC and eCCA | |

| ● | In solid tumors without identifiable feeder vessels, TAMP is technically easier than direct cannulation of small tumor feeder blood vessels | |

| ● | High local concentration of drug into the tumor tissue | |

| ● | Potential for decreased systemic exposure of drug due to local metabolism prior to systemic exposure |

| 7 |

Developing a therapeutic platform using an adjustable two-balloon catheter and IA gemcitabine

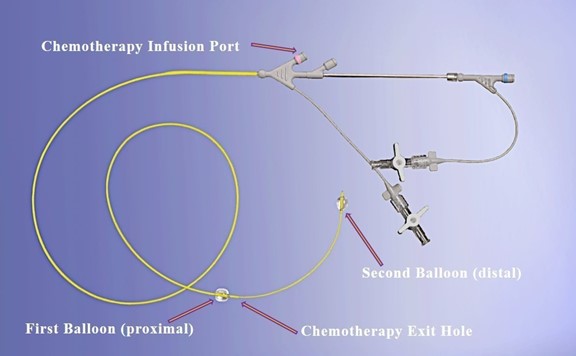

By isolating the vessel adjacent to the tumor and creating a pressure gradient across the arterial wall between the isolated vessel segment and the surrounding tissue or tumor, we are able to force the small molecule chemotherapy across the vessel directly into surrounding tissue or tumor. To accomplish this, we needed a minimally invasive technique to isolate the blood vessel next to the tumor, exclude any branches that can cause washout of chemotherapy away from the target, and then infuse the chemotherapy into the isolated segment to achieve pressure mediated diffusion through the vessel wall and into the tumor tissue. We accomplished this with our patented RenovoCath delivery system. RenovoCath is a double balloon catheter designed with the capability to isolate the proximal and distal sections of the vessel through the adjustment of the distance between the balloons, thereby excluding any branching blood vessel offshoots. Using standard interventional techniques, an interventional radiologist inserts the RenovoCath delivery system into the body through the femoral artery and positions it in the artery closest to the tumor. Once the balloons are inflated and the position is confirmed, chemotherapy is delivered through the handle, exiting the device between the balloons. It is forced through the vessel wall into the tissue over a 20-minute period. The RenovoCath delivery system is depicted below in Figure 5.

Figure 5: RenovoCath delivery system illustrating two balloon configuration to isolate the target vessel segment, and chemotherapy delivery port and exit hole.

After the procedure is complete, RenovoCath is discarded, and the patient is generally discharged the same day. On average, the entire procedure takes approximately 90 minutes. According to the TIGeR-PaC study protocol, IA treatment is administered through RenovoCath every other week for a maximum of 8 treatments for approximately 16 weeks. Interventional radiologists using the device are typically proctored for their first 2-3 cases only. In addition, platform training for our primary indication should transfer to other indications.

| 8 |

RenovoGem for LAPC

Disease Overview

Pancreatic cancer is one of the deadliest cancers in the U.S. with very poor outcomes. According to American Cancer Society’s Cancer Facts & Figures 2023, pancreatic cancer has a 5-year combined overall survival rate of 12% (Stages I-IV) and is on track to be the second leading cause of cancer-related deaths before 2030. LAPC is diagnosed when the disease has not spread far beyond pancreas, however, has advanced to the point where it cannot be surgically removed. LAPC is typically associated with patients in stage 3 of the disease as determined by the TNM (tumor, nodes and metastasis) grading system.

Current Treatment Landscape and Limitations

Pancreatic cancer has limited treatment options including one or a combination of surgery, radiation, chemotherapy, and/or some targeted therapies. Only a small subset of pancreatic cancer patients is eligible for surgery (“Resectable” at the time of presentation (Stage I-II: 15%); the rest are distributed between having tumors with unresectable LAPC (Stage III: 30%) and metastatic pancreatic cancer (Stage IV: 50%).

Chemotherapy is at the forefront of systemic therapy for cancer. It can be used in the neoadjuvant (before surgery) setting to attempt to decrease tumor size in resectable or borderline resectable patients, in the adjuvant (after surgery) setting, or first line in the metastatic/advanced setting. The backbone of our first product candidate, gemcitabine, is a nucleoside metabolic inhibitor that exhibits antitumor activity by blocking the synthesis of new DNA, which results in cell death. Gemcitabine administered as an IV infusion has an established role in the treatment of both unresectable LAPC and metastatic pancreatic cancer. Since its introduction in the US as Gemzar® (gemcitabine for injection) in 1996 with an FDA approved indication as such, it remains in the guidelines as standard of care. It has been demonstrated to provide clinical benefit for subjects (decreased pain and improved performance status) as well as to improve the time to tumor progression and survival for subjects with metastatic pancreatic cancer and LAPC. However, major improvement in the survival curve of all pancreatic cancer subjects has been a clinical challenge, with an average median survival time for LAPC stalled at 12-15 months from time of diagnosis.

A key limitation of conventional chemotherapy in these tumors can be attributed to their avascular nature and desmoplasia (fibrosis or the growth of scar tissue) that impedes drug delivery. Pancreatic tumor cells have a thick and poorly perfused stroma, or connective tissue, and high interstitial pressure. This can potentially constrict blood vessels leading to an avascular or hypovascular environment that impedes chemotherapy from reaching tumor cells in high enough volume, rendering them relatively resistant to chemotherapy.

In patients with metastatic disease, two chemotherapy combination regimens have shown superiority to gemcitabine, albeit with increased toxicity. First, the combination of oxaliplatin, irinotecan, fluorouracil, and leucovorin (FOLFIRINOX) in a relatively young cohort of metastatic pancreatic cancer patients appears superior to gemcitabine by improving survival from 6.8 to 11.1 months. Second, in the Metastatic Pancreatic Adenocarcinoma Clinical Trial (MPACT) trial, the combination of gemcitabine plus nab-paclitaxel (Abraxane) demonstrated an OS benefit of 9 weeks versus gemcitabine alone at the cost of increased toxicity.

A major focus of clinicians is determining the optimal method to treat patients with LAPC, patients with localized disease who are not surgical candidates, roughly 30% of all pancreatic cancer patients. IV, or systemic, administration of chemotherapy has yielded unsatisfactory results in these patients. Various localized treatments have included high dose local radiation, direct attempts at local injection of drugs, and use of adenoviral vectors to deliver toxic agents. These treatment options demonstrated limited success in the treatment of LAPC. The lack of successful treatment options represents a recognized unmet medical need for these patients.

Standard of care chemotherapy for the treatment of pancreatic cancer has historically shifted a couple of times with the addition of erlotinib to gemcitabine 15 years ago resulting in a 14-day survival benefit. In 2013, the addition of Abraxane to gemcitabine was approved, with immediate deep market penetration based on an 8-week survival benefit despite higher systemic drug toxicities.

| 9 |

Our Solution

We believe that our product candidate, RenovoGem, has the potential to address the recognized unmet medical need. Utilizing our patented TAMP therapy platform, we believe RenovoGem can enhance local drug concentration, thereby increasing efficacy and decreasing systemic exposure and toxicity to improve patient outcomes. RenovoGem is a drug/device combination product candidate consisting of IA gemcitabine and our proprietary RenovoCath delivery system which forces the anti-cancer drug into the tumor. RenovoGem is regulated by the FDA as a new oncology drug product. While we may explore commercial opportunities to sell RenovoCath as a standalone catheter, our main focus currently is to sell RenovoCath in combination with IA gemcitabine (as RenovoGem) or potentially with other therapeutic agents.

Based on primary market research and analysis of the U.S. market sponsored by us and conducted by third parties, we believe that over 5,000 patients per year would be excellent candidates and undergo RenovoGem treatment if and once it is approved in the U.S. The independent oncologists interviewed stated their dissatisfaction with current standard of care and the strong desire for a therapy like ours to extend potential survival while maintaining quality of life. Further, the analysis suggests, based on analogous oncology drugs with only a modest efficacy benefit, a novel drug can expect 50-80%+ penetration in a first line setting. The results of the Key Opinion Leader, or KOL interviews revealed that a majority of oncologists would refer 90%+ of their LAPC patients who are eligible for the procedure for TAMP if the current Phase III trial demonstrates at least a 4-month survival benefit over systemic chemotherapy. As of March 8, 2023, we announced interim analysis results of the study suggesting a 6-month potential improvement in median overall survival with RenovoGem, pending ongoing clinical investigation. We believe this first-of-two interim analyses indicates that the TIGeR-PaC study is on track to demonstrate increased lifespan for patients being treated with RenovoGem for LAPC.

Figure 6: We invented a new therapy platform, TAMP, that uses pressure to force small molecule chemotherapeutics across the vessel wall into the surrounding tissue using our patented RenovoCath delivery system. Our first product candidate, RenovoGem, is a drug/device combination of IA gemcitabine and the RenovoCath delivery system, and is under development for LAPC and eCCA. We have secured Orphan Drug Designations for RenovoGem for the treatment of both pancreatic cancer and cholangiocarcinoma.

| 10 |

Clinical Development of RenovoGem in LAPC

Preclinical Studies and Data

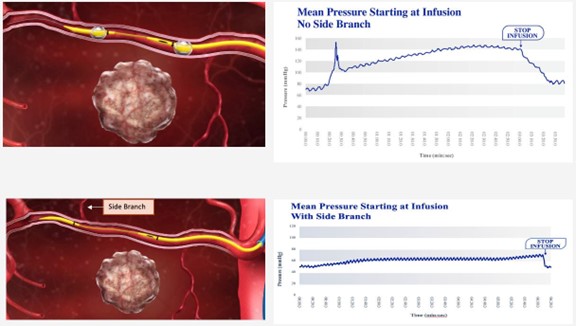

Once RenovoCath is introduced via standard interventional technique to the arterial vessel segment next to the targeted tissue, both balloons are inflated, and the vessel segment is isolated from the rest of the circulatory system. With inflation of balloons, the pressure is observed to drop within the vessel. However, with infusion of fluids between the balloons, the intravascular pressure increases beyond 45 mmHg until plateauing, generating a gradient and trans-arterially forcing the infusate across the arterial wall via diffusion or Trans-Arterial Micro-Perfusion (i.e., TAMP). A key aspect of this approach is to adjust the distance between the balloons to exclude any side blood vessel branches in the isolated segment to allow the increase in pressure gradient, rather than drug washout via the side branches. Figure 7 shows a comparison, in an animal study, between proper balloon positioning with no side branches, allowing maximum drug to cross the arterial wall, versus improper balloon positioning to include side branches, resulting in drug washing out via the side branches.

Figure 7: Top panel demonstrates proper balloon positioning with no side branch. Pressure increases with infusion and reaches a plateau of approximately 75 mmHg higher than initial pressure. Bottom panel demonstrates improper balloon positioning with side branch between the balloons. Pressure increases with infusion and reaches a plateau of approximately only 15mmHg higher than initial pressure.

| 11 |

With diffusion of fluids across the arterial wall in TAMP, we expected to be able to deliver small molecules into the surrounding tissue. We performed the following studies to validate this hypothesis:

| 1) | In a preclinical study, 99% of the gemcitabine crossed the arterial wall via TAMP. |

In explanted (dissected out of the animal and used separately in a saline water bath) pig iliac and aortic artery, with the introduction of RenovoCath and infusion of gemcitabine in the isolated vessel segment, we were able to measure (in a time dependent fashion) the amount of gemcitabine crossing the arterial wall into the surrounding fluid. We isolated the arterial vessel segment using RenovoCath and then delivered 60 mg/minute of gemcitabine into the isolated area over 20 minutes. By the end of the infusion, we measured 1,188 mg of gemcitabine in the surrounding fluid around the vessel and 9 mg in the analyzed tissue of the vessel. This demonstrated that 99% of the drug crosses the arterial wall and only 0.75% is retained in the arterial tissue (Figure 8).

Figure 8: TAMP: delivery of chemotherapy through the RenovoCath and into the tissue to bathe the tumor in chemotherapy. In a preclinical study using gemcitabine, 99% of the drug crosses the arterial wall and less than 0.75% is retained in the vessel wall tissue.

| 2) | Infusion of gemcitabine via TAMP has demonstrated vascular safety with acceptable toxicity in a pig model and does not cause loss of vessel integrity or inflammation. |

Six pigs were treated with gemcitabine via TAMP (6 mL/min for 20 minutes). Target vessels included selection of the superficial femoral artery (SFA) and splenic arteries from each animal (either test or saline control). A total of 6 vessels (3 SFA and 3 splenic arteries) were treated with an equal number of control vessels. All animals survived the 7-day in-life period although two of the animals with gemcitabine treatment in the splenic artery experienced atypical pain during the post-operative phase and required additional pain management with eventual complete recovery.

Analysis of the vessels demonstrated preserved vessel shape with intact endothelial cells (cells on the inside of the vessels). Minimal to no inflammation was observed. The only vessel toxicity observed was a reduction of smooth muscles cells in the vessel wall, primarily close to the inside of the vessel.

| 3) | In preclinical studies, TAMP achieved targeted local drug (dye) delivery. |

I. Targeted small molecule delivery (dye) into pancreatic tissue

We further validated our approach for tissue drug delivery using acute animal experiments. Using both dye and gemcitabine infusion via the TAMP therapy, we were able to demonstrate that fully isolating a segment of a vessel (by blocking inflow and outflow in the target vessel as well as side branches with the RenovoCath double balloons) can lead to dye penetration greater than 4.0 cm from the vessel wall and drug tissue concentration (gemcitabine) up to 100-fold greater than systemic administration.

| 12 |

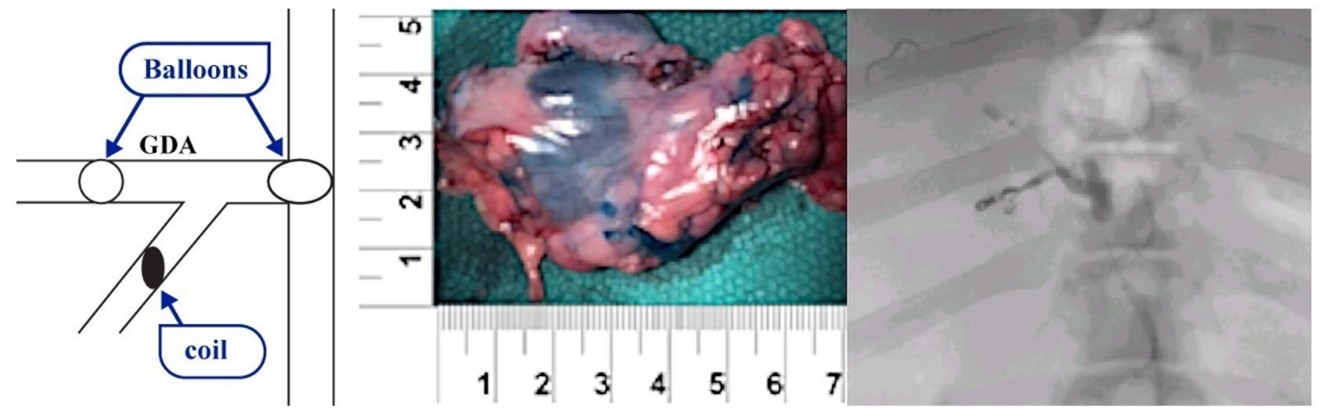

In an acute pig experiment, RenovoCath was introduced into the gastro-duodenal artery (GDA), a side branch was excluded (using small implants that block the artery, coils), and then dye was introduced at 6mls/minute over 2 minutes. Analysis demonstrated that the blue dye diffused covered approximately 10.56 cm2 (2.2 cm x 4.8 cm) of the pancreas.

Figure 9: RenovoCath was introduced into the GDA and a side branch was excluded by coiling. This test was conducted in an acute porcine model and demonstrated a dye coverage area of approximately 10.56 cm2 for a 2-minute dye infusion. All dimensions in above figure are in cm.

The study was repeated in 6 other vessel targets to validate the impact of vessel isolation on dye penetration into the surrounding tissue with similar results.

II. Small molecule delivery (dye and gemcitabine) locally into lung tissue

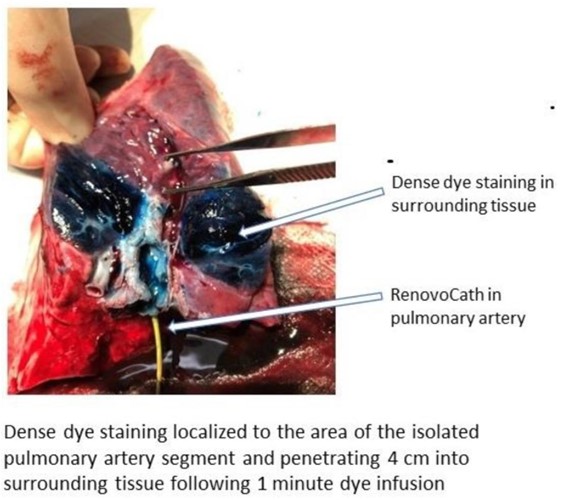

In another set of acute animal experiments, the pulmonary artery was isolated via access through the internal jugular vein. Six ml of methylene blue dye was injected over 1 min and gemcitabine was subsequently delivered locally at rate of 6 mls/minute for 20 minutes to the lung tissue using the TAMP procedure.

| 13 |

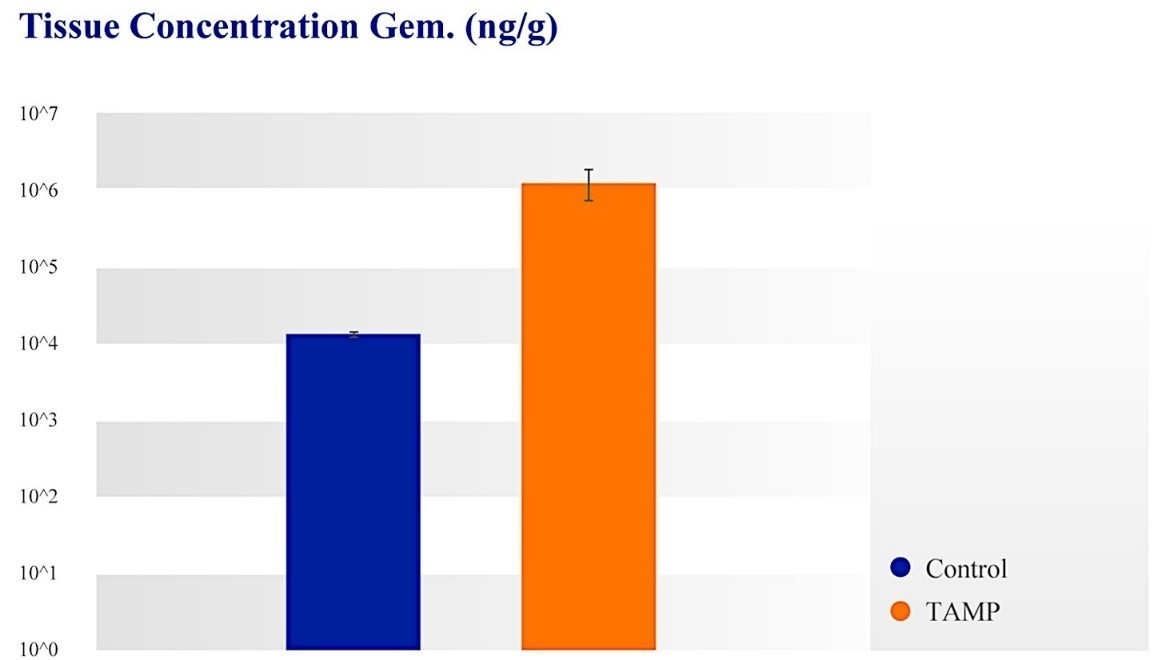

Dense dye staining localized to the area of the isolated vessel segment was observed. Again, analysis established penetration into surrounding tissue (4 cm). Furthermore, TAMP achieved greater than 100-fold tissue concentration of gemcitabine versus the tissue level achieved by IV (systemic) delivery of gemcitabine at the same infusion rate.

Figure 10: Dense dye staining localized to the area of the isolated pulmonary artery segment and penetrating 4 cm into surrounding tissue following 1 minute dye infusion. In addition, gemcitabine was delivered via TAMP for 20 minutes demonstrating 100-fold increase in tissue concentration of gemcitabine compared to IV delivery of gemcitabine at the same infusion rate.

| 14 |

We concluded that TAMP can achieve drug penetration into the surrounding tissue and can achieve high dose concentrations in local tissue. The tissue concentration with IV and/or distant from TAMP site (likely after recirculation through systemic system) were two orders of magnitude lower than tissue levels achieved with TAMP (p<0.02).

Figure 11: Local tissue concentration of gemcitabine. control (Blue): Intravenous infusion versus TAMP (Orange): TAMP: IA infusion. The tissue concentration with intravenous infusion and/or distant from TAMP site (likely after recirculation through systemic system) are 100-fold lower than tissue levels achieved with TAMP.

This animal lung study successfully validated the ability of RenovoCath to deliver small molecules locally and effectively to lung tissue.

III. Based on the results of preclinical studies, increase in local tissue delivery of gemcitabine in LAPC may enhance tumor reduction and therapeutic response

In relevant mouse models of pancreatic tumors, it has been demonstrated that targeted IA infusion of gemcitabine into the pancreas after surgical isolation of arterial blood flow has a superior therapeutic effect with greater reduction in tumor volume compared to the same concentration administered by conventional IV injection. To achieve a comparable reduction in tumor growth as seen with IA treatment, gemcitabine had to be given intravenously at over 300 times the dose which was associated with increased toxicity.

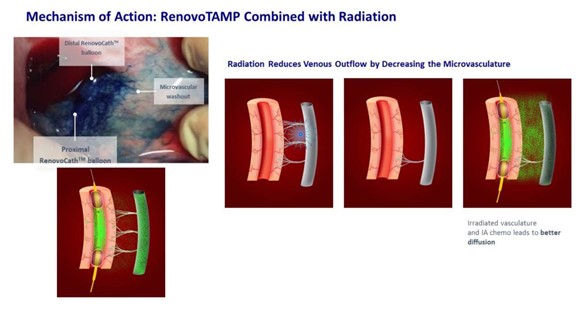

TAMP and Radiation

Traditionally the goal of radiation includes debulking the tumor and/or acting as a chemo-sensitizer. In our RR1 dose escalation safety study and RR2 observational registry study, the benefit of TAMP appeared to be enhanced in patients with prior radiation. As we were observing this effect months after radiation and although several randomized studies have not demonstrated a benefit of chemotherapy plus radiation versus chemotherapy alone, we hypothesized that a direct effect of radiation on the vasculature may be enhancing the effect of TAMP. One of the side effects of radiation is a decrease in the micro-vasculature in the irradiated tissue including the small blood vessels that exist in the vessel walls themselves. Therefore, we postulated that by eliminating microvasculature in and around the vessel wall, radiation may enhance drug penetration into the tissue via TAMP (Figure 12). As such, a possible enhancing effect of radiation on TAMP may involve decreasing washout of the drug as it crosses the arterial wall by preventing draining into the surrounding microvasculature.

| 15 |

We completed a pig study where we observed the impact of TAMP in recruiting the vasa vasorum (small blood vessels within the larger blood vessel walls) around the vessel during drug/dye infusion. It was discovered that the dye drained into the vasa vasorum and other small vessels in the adjacent tissue (Figure 12); as these vessels can directly connect to the adjacent venous system, the microvascular networks can serve as an “escape route” for drugs. Ultimately this direct washout can reduce the amount of drug concentration in the tissue. Radiation pretreatment may enhance the impact of TAMP by attenuating this escape route.

Figure 12: Mechanism of TAMP and radiation reduces venous outflow by decreasing the microvasculature networks that could act as an “escape route” for the drugs. The photo on the left illustrates this effect in a dye infusion study in the porcine animal model. The panel on the right demonstrates venous chemotherapy washout without radiation versus less venous escape routes for chemotherapy following radiation.

| 16 |

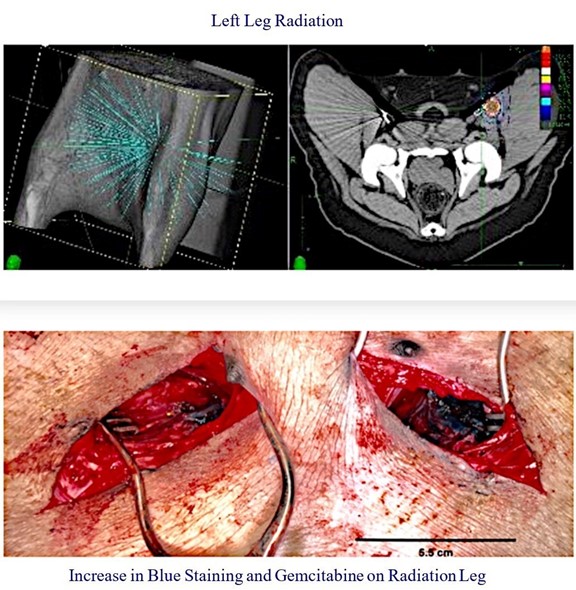

We further advanced this theory by conducting a pig study to directly test whether radiation can enhance tissue uptake by TAMP. In a single-animal study, we examined the use of SBRT pre-treatment on one leg followed by TAMP versus TAMP without prior radiation therapy on the opposite leg. The leg of the animal that was pre-treated with radiation demonstrated more pronounced tissue staining with methylene blue dye and increased gemcitabine concentration via punch biopsy. Based on these findings, we believe that the benefit of prior radiation on clinical outcomes with TAMP may be improved by the effect of radiation on microvasculature between the vessel wall and the tumor.

Figure 13: To demonstrate the effect of radiation pre-treatment, we delivered radiation therapy to the left leg of a pig. After waiting one month for the therapy to fully affect the vasculature, we performed TAMP on the left and right leg arteries with blue dye and gemcitabine. Dissection revealed better dye penetration into the tissue on the left (irradiated) leg, and punch biopsy demonstrated higher gemcitabine concentration in the left leg.

We have demonstrated that the TAMP therapy allows targeted small molecule drug delivery into the tissue surrounding the vessel wall, without need to identify tumor feeder blood vessels. The mechanism of action is the exclusion of distal (downstream) and side branch vessels in the isolated segment and creating a pressure gradient by infusing the drug over time. The pressure gradient results in a diffusion-mediated delivery of drug into the surrounding tissue. With the use of gemcitabine, the procedure appears safe in terms of local toxicity in the vasculature. Using this approach, we can achieve increased drug delivery into the surrounding tissue in the range of 4 cm-tissue penetration as well as concentration orders of magnitude larger than what can be achieved with IV infusion. Lastly, TAMP appears to be enhanced by prior radiation of tissue, possibly by decreasing the microvasculature and subsequent potential chemotherapy washout.

| 17 |

LAPC Clinical Development

TAMP has been studied in a Phase I/II dose-ranging study of 20 subjects with LAPC (RR1) and in an observational study that enrolled 25 additional subjects with pancreatic cancer (RR2); two subjects from the RR1 safety study continued to receive treatment in the RR2 observational registry study. We subsequently launched a Phase III registration trial (TIGeR-PaC). On March 8, 2023, we announced interim analysis results of the study suggesting a 6-month potential improvement in median overall survival with RenovoGem, pending ongoing clinical investigation. We believe this first-of-two interim analyses indicates that the TIGeR-PaC study is on track to demonstrate increased lifespan for patients being treated with RenovoGem for LAPC. Final analysis will be conducted after 86 protocol-specified events have occurred in the SBRT population with two planned interim analyses: this first analysis with 30% of the specified events (deaths) reported and the second analysis when 60% of the events have been reported (expected in 2024).

Phase I/II Dose-Ranging Study: RR1

Study Design

A Phase I/II safety study of our TAMP therapy has been completed in subjects with LAPC (Phase I/II RenovoCath/Gem RR1). This multicenter, prospective, open label, interventional, nonrandomized, intra-subject dose escalation study evaluated IA gemcitabine delivered locally to the pancreas using RenovoCath in 20 subjects with LAPC. The primary objectives of the study were (1) to establish the maximum tolerated dose (“MTD”) and (2) to study the safety and tolerability of IA gemcitabine administered by RenovoCath at doses ranging from 250 mg/m2 to 1000 mg/m2. Secondary endpoints included overall survival, CA 19-9 marker change, change in tumor size based on RECIST 1.1 (Response Evaluation Criteria in Solid Tumors) criteria, and pain scores and narcotic use. Adverse events were collected from the first IA gemcitabine infusion until 3 months following the final IA gemcitabine infusion. Subjects were followed for survival.

Treatment constituted introducing RenovoCath to target vessel (adjacent to tumor) via catheterization, occluding the targeted segments via the RenovoCath balloons, and infusing gemcitabine in the occluded segment. To minimize ischemia (damage due to cessation of blood flow) the infusion was limited to 20 minutes and an anticoagulant (heparin) was given during the procedure. Tissue markers were followed post procedure to ensure lack of local tissue damage-toxicity (AST, ALT, Lipase and Amylase).

Treatment was administered in four 28-day cycles, each of which consisted of two IA doses of gemcitabine, one on day 1 and one on day 15, with a two-week rest period between cycles. The first six subjects received a starting dose of 250 mg/m2, and doses increased by 250 mg/m2 in each subsequent cycle culminating with the full dose of 1,000 mg/m2. After the initial six subjects, the starting dose increased to 500 mg/m2 for one cycle, after which dosing increased to 750 mg/m2 for the second cycle, and then the full 1,000 mg/m2 dose for the remaining 2 cycles. Each subject underwent CT scanning prior to the first procedure for the selection of the optimal target vessel most proximal to the tumor.

Study Subjects and RenovoGem Exposure

The median age of subjects was 66.7 years with a gender distribution of 9 men and 11 women. Prior treatment included chemotherapy and radiation therapy in 6 (30%), chemotherapy alone in 5 (25%) and no prior therapy in 9 (45%) subjects. Collectively the 20-subject cohort received 101 IA treatments. It is important to note that 9 of the 20 subjects had a biliary stent or drain in place before the first IA procedure.

Trial Results

Safety

There was no evidence of local tissue toxicity in any patients post procedure as measured by liver and pancreatic enzymes. Out of 101 procedures, adverse events were reported in 11 subjects, including catheterization/procedure-related events with arterial dissections at treatment sites (3), pseudoaneurysm in a visceral artery (1), complications away from the treatment site and site complications (2).

| 18 |

Serious adverse events were reported in 9 subjects during the study. Overall survival (including deaths that occurred following disease progression) was followed in all study subjects. The number of subjects with serious adverse events is shown in the table below.

Summary of Serious Adverse Events for 9 subjects in RR1 Dose Ranging Study

| Serious Adverse Event | N=20 | |

| Cardiac Arrest | 1/20 (5%) | |

| Dehydration | 1/20 (5%) | |

| Duodenal obstruction | 1/20 (5%) | |

| Gastritis | 1/20 (5%) | |

| Infection | 1/20 (5%) | |

| Intraoperative arterial injury-dissection | 3/20 (15%) | |

| Intraoperative arterial injury-lower extremity | 1/20 (5%) | |

| Pain-Abdominal NOS | 1/20 (5%) | |

| Respiratory failure | 1/20 (5%) | |

| Sepsis | 3/20 (15%) | |

| Neutropenia | 4/20 (20%) |

This table shows serious adverse events reported in 9 of the 20 subjects during the study. Several subjects had more than one serious adverse event.

Efficacy

The principal evaluation of efficacy was survival. All subjects were followed for survival after the end of IA gemcitabine treatment. All subjects have died, with the longest having an overall survival of 35.9 months.

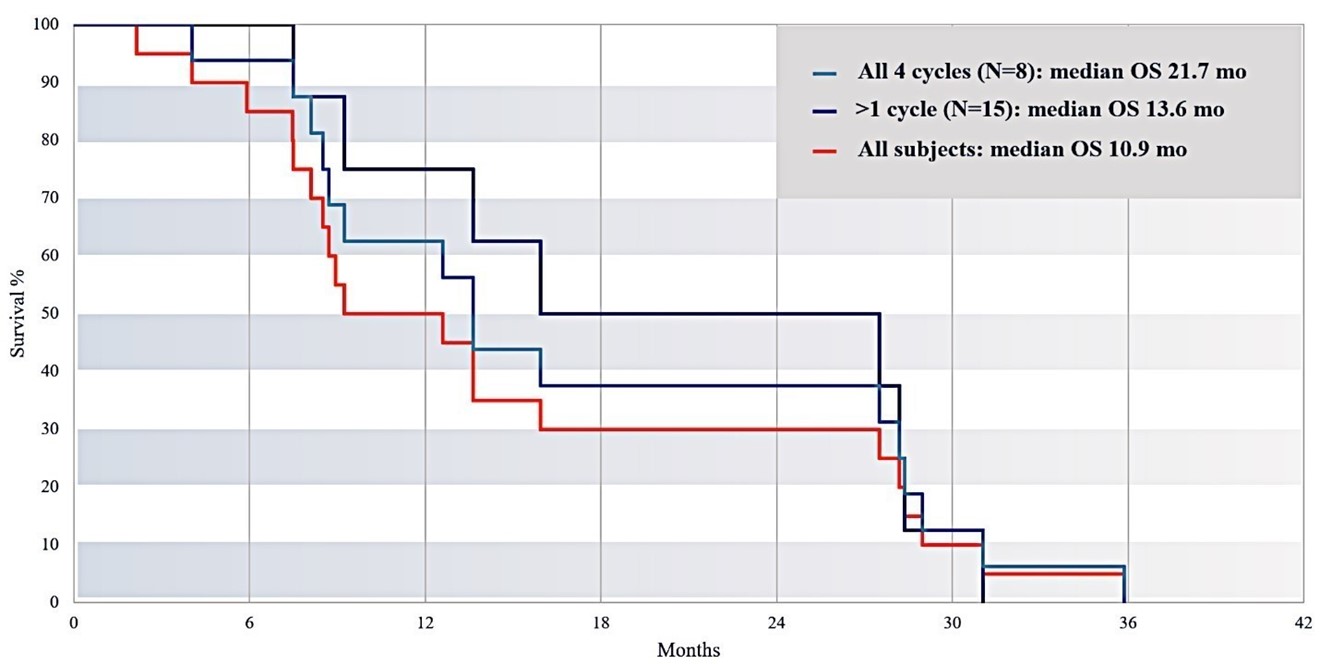

Subjects Who Received More IA Treatment Cycles Survived Longer

Figure 14: This chart shows survival as a function of total number of IA treatment cycles received. Subjects receiving all 4 cycles (n=8) had a median survival time of 21.7 months, compared to a median survival time of 10.9 months for all subjects (n=20).

| 19 |

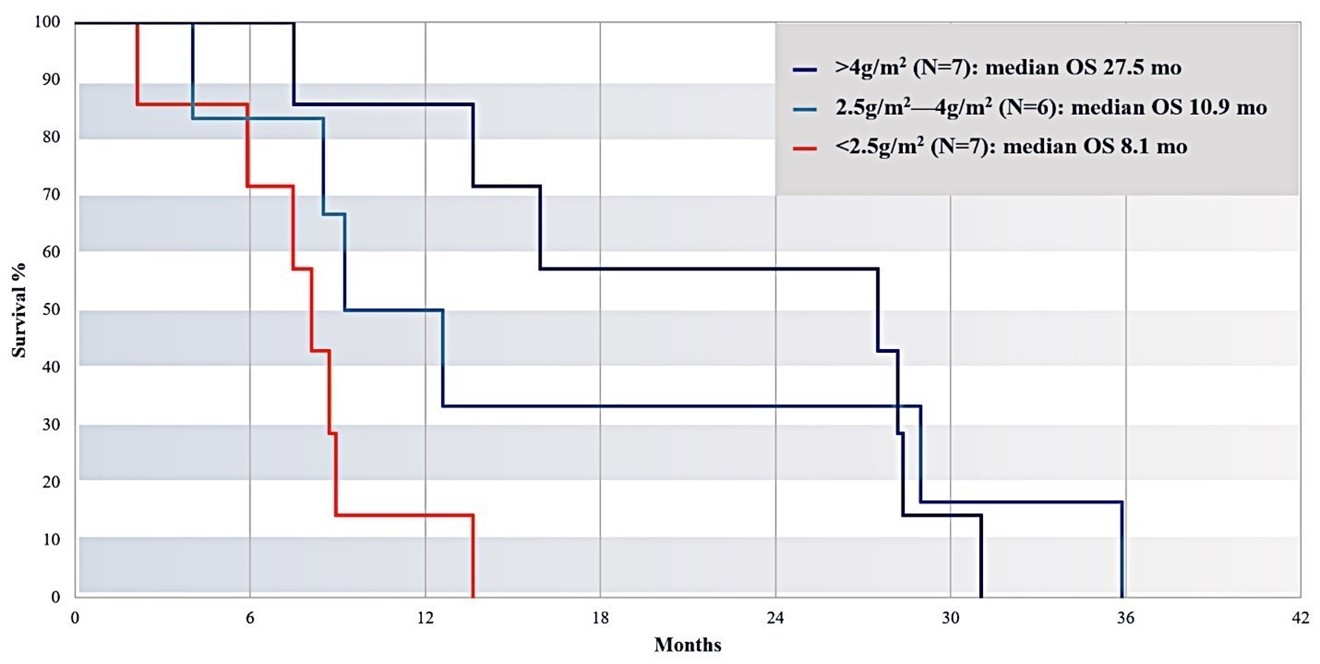

Subjects Who Received Greater Cumulative Exposure to RenovoGem Survived Longer

Figure 15: Splitting the entire cohort into equal tertiles based on total dose received, patients receiving the lowest total dose (<2.5g/m2; n=7) demonstrated the lowest median overall survival (8.1 months) compared to patients in the group receiving the next higher total dose (>2.5g/m2, but <4g/m2; n=6; median OS=10.9 months), and patients in the group receiving the highest total dose (>4g/m2; n=7; median OS=27.5 months).

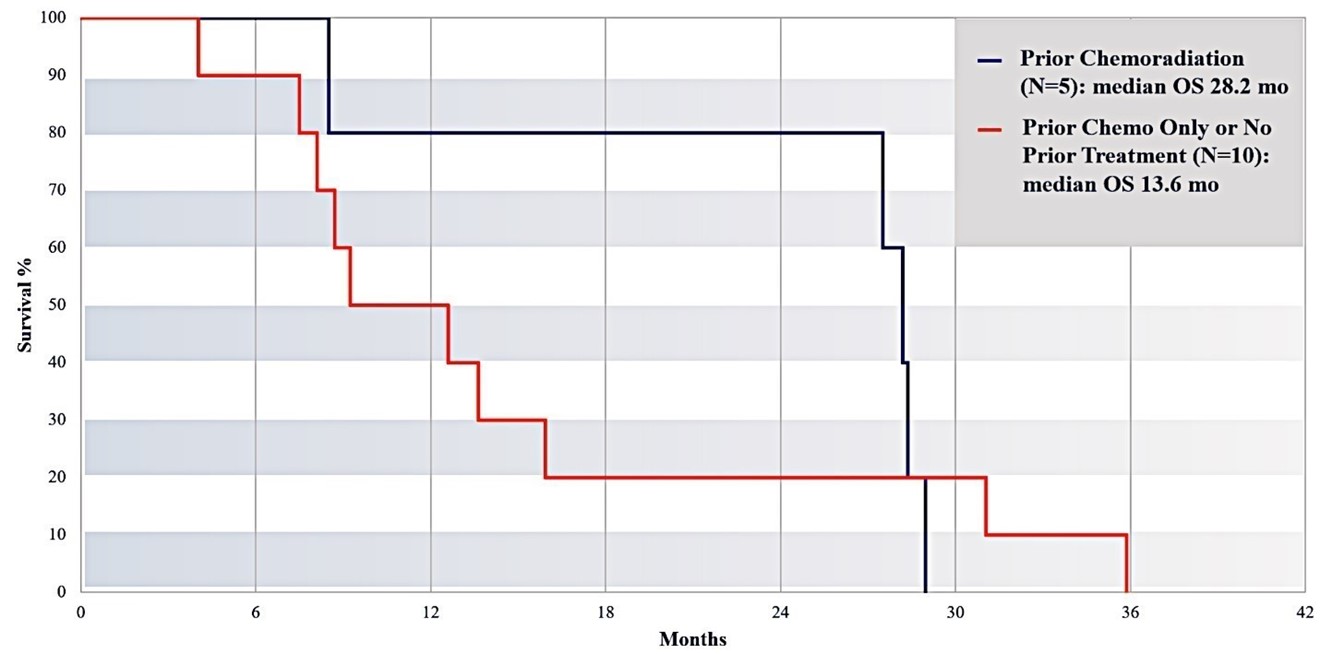

Subjects Who Had Prior Radiation Exposure Survived Longer Than Those Who Did Not

As shown below in Figure 16, fifteen subjects received more than 1 cycle of IA gemcitabine treatment. The red line represents subjects without any prior treatment or received prior chemotherapy only (n=10; median OS=13.6 months). The dark green line depicts subjects who received prior chemoradiation (n=5; median OS=28.2 months). P < 0.05 for survival between the two subsets. Survival appeared to be longer in subjects who had prior chemoradiation.

Figure 16: Survival of subjects with or without prior chemoradiation. Subjects with prior chemoradiation (n=5) had a median survival time of 28.2 months, compared with a median survival time of 13.6 months for subjects without prior chemoradiation (n=10).

| 20 |

Disease Progression Based on RECIST 1.1 Criteria

The RECIST 1.1 criteria was used to compare the baseline and follow up CT images submitted by sites. Follow-up CT scans obtained 5 months after initiation of IA gemcitabine therapy were submitted for 17 of the 20 subjects and were compared to the baseline images. Six of the 17 subjects (35.3%) experienced tumor progression, 1 (5.9%) had a partial response, and 10 (58.8%) demonstrated stable disease 5 months post treatment initiation. Two of the 6 subjects with tumor progression received less than 1 cycle (only 1 treatment) of IA gemcitabine. Among 15 subjects who received more than 1 cycle (2 treatments), 26.7% had disease progression, 6.7% had partial response and 66.7% had stable disease 5 months post IA therapy.

CA 19-9 Tumor Marker Change

CA19-9 is a protein that can be detected in serum and is a biomarker of pancreatic cancer; its levels can be used to assess tumor response to therapy. Twelve of 20 subjects had measurable CA 19-9 tumor markers. The final CA 19-9 tumor marker levels were lower in 7 of 12 (58%) and greater in 5 of 12 (42%) subjects. It is notable that final tumor marker levels were lower in 4 of 5 subjects with prior chemoradiation and higher in 5 of 7 subjects without prior chemoradiation.

Observational Registry Study RR2

We launched the RR2 observational registry study in January 2016 to further explore the clinical utility of the TAMP procedure. The key inclusion criteria were patients with locally advanced or borderline resectable pancreatic adenocarcinoma confirmed by histology or cytology. This was an observational patient registry study with endpoints of safety and survival following IA gemcitabine treatment with RenovoCath. The study was conducted at 7 sites in the US and subsequently closed on August 2019 except for one US site (that did not participate in the Phase III study). This last site in the study was officially closed in September 2020. Over the 3 years that the trial was open, we enrolled 25 subjects with LAPC. Two of those subjects had participated in our Phase I/II RenovoCath/Gem RR1 trial: each received 8 IA gemcitabine infusions prior to enrollment in the RR2 study. A summary of data updated through January 2021 is presented below.

The study initially enrolled LAPC subjects without regard to prior radiation or chemotherapy. In April 2017, after the observation of longer survival of subjects with prior chemoradiation versus subjects who had not had prior radiotherapy, entry into the registry was restricted to subjects with LAPC who had received prior radiation. Of note, one subject who had prior pancreatic cancer surgery (Whipple procedure) would not normally have been enrolled in the study but was included for safety observations as her physician had previously planned IA gemcitabine therapy.

Investigators in the study reported all Serious Adverse Events from the first IA gemcitabine infusion to at least 60 days after their last procedure, but reporting of non-serious adverse events was optional. All subjects received gemcitabine 1000 mg/m2 every two weeks, except one who received 500 mg/m2, typically for a total of 8 doses. Subjects were followed post-treatment for survival.

Study Subjects and RenovoGem Exposure

Twenty-five subjects were enrolled at 7 sites. The study enrolled 15 women (60%) and 10 men (40%); with a mean and median age of 73. Of the 25, 10 (40%) had no prior therapy, 8 (32%) had prior radiotherapy and chemotherapy, 6 (24%) had prior chemotherapy alone and 1 (4.5%) had surgery (Whipple procedure).

Two subjects were continuations from the previous Phase I/II RenovoCath/Gem RR1 study, and as a result, received more than eight treatments (total in both studies). The treatment received summary is shown in the table below:

Dosing Treatments for RR2 Observational Registry Study, for 25 Subjects Enrolled at 7 Sites

| Number of Dosing Treatments | N=25 | |

| 1 | 5/25 (20%) | |

| 2 | 3/25 (12%) | |

| 3 | 4/25 (16%) | |

| 4 | 5/25 (20%) | |

| 6 | 2/25 (8%) | |

| 7 | 2/25 (8%) | |

| 8 | 2/25 (8%) | |

| >8 | 2/25 (8%) |

| 21 |

Twenty-five subjects, 15 women (60%) and 10 men (40%); with a mean and median age of 73 were enrolled at 7 sites. Of 25, 10 (40%) had no prior therapy, 8 (32%) had radiotherapy and chemotherapy, 6 had chemotherapy alone and 1 (4.5%) had surgery (Whipple procedure).

In the 25 patients, 109 total IA treatments were administered through one or more of the following arteries:

| ● | Common Hepatic Artery | |

| ● | Splenic Artery | |

| ● | Celiac Axis | |

| ● | Superior Mesenteric Artery |

Trial Results

Safety

There were a number of adverse events reported. The most common were nausea (36%), vomiting (28%), abdominal pain (32%), followed by vascular access complications (16%). The less common adverse events reported (< 5%) included rash, allergic reaction, retroperitoneal hemorrhage, sepsis, ischemic bowel, arterial spasm, atrial fibrillation, chest pain, back pain, hypoglycemia, pruritis, and other GI issues. No deaths were noted in the immediate post-treatment period. No deaths were considered related to study treatment. Survival is summarized as an efficacy evaluation.

Summary of Key Safety Observations

| ● | Neither pancreatitis nor local tissue toxicity was reported in LAPC subjects without prior surgery. | |

| ● | There was no instance of arterial dissection in this study. | |

| ● | The incidence of sepsis was lower in this study (1/25 subjects receiving 94 infusions) compared with the incidence in Phase I/II RenovoCath/Gem RR1 (3/20 subjects receiving 101 infusions). The subject with sepsis did not have a biliary stent or drain and the source of the sepsis was not identified. No sepsis events were noted after 51 infusions in 12 subjects with biliary stents, who received peri-procedure antibiotics. The incidence of sepsis in the RR2 observational registry is like that of pancreatic cancer subjects receiving myelosuppressive chemotherapeutic regiment in other studies. |

Efficacy

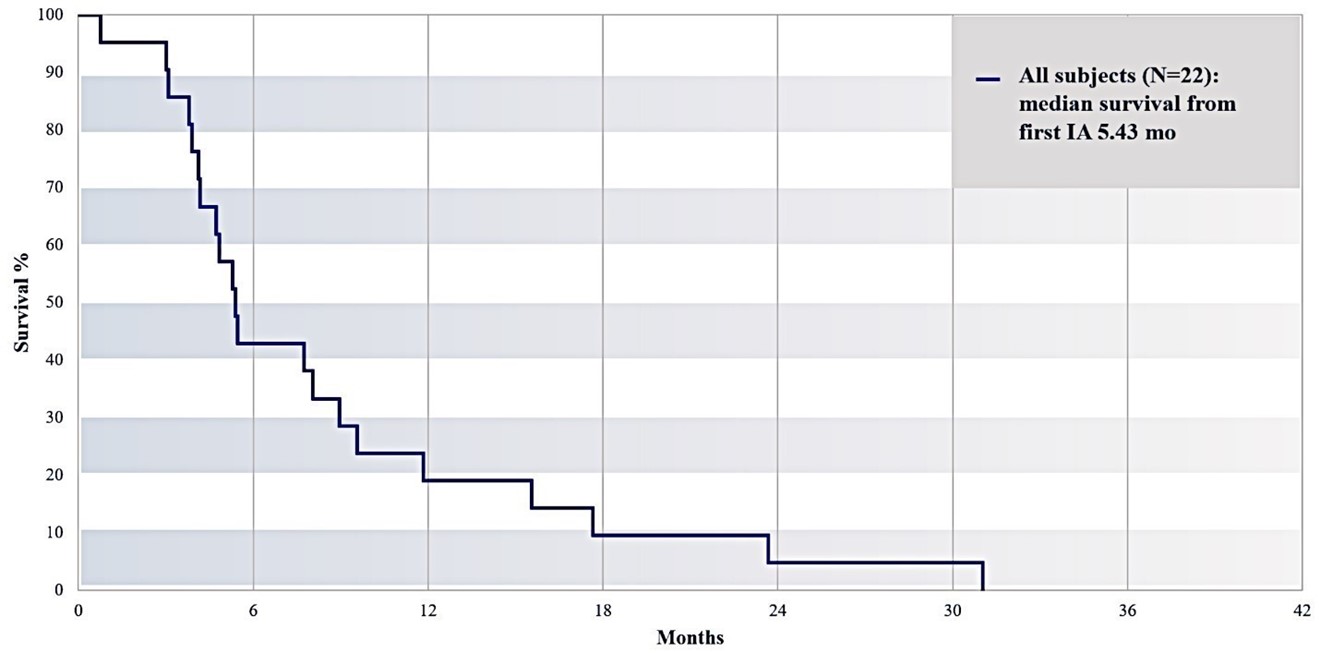

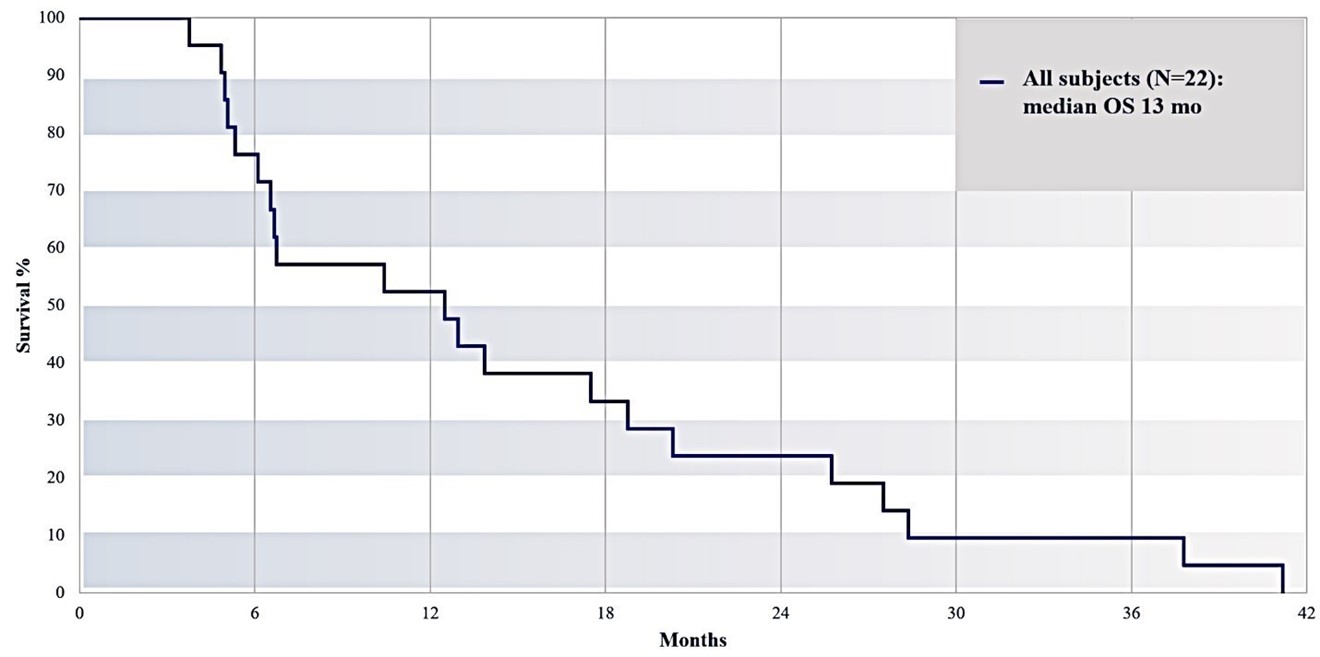

Excluding the subjects with prior or post pancreatic cancer surgery, median survival (n=22) from the time of first IA gemcitabine treatment was 5.43 months, as illustrated in Figure 16 below, whereas median overall survival (from date of diagnosis) was 13.0 months (Figure 17).

| 22 |

Survival of all Subjects from first IA Gemcitabine Treatment (Median 5.43 Months)

Figure 17. Overall RR2 observational registry study cohort (N=22) survival from first IA treatment until date of death.

Overall Survival of All Subjects (Median Overall Survival 13 Months)

Figure 18: Overall RR2 observational registry study cohort (N=22) overall survival from date of diagnosis.

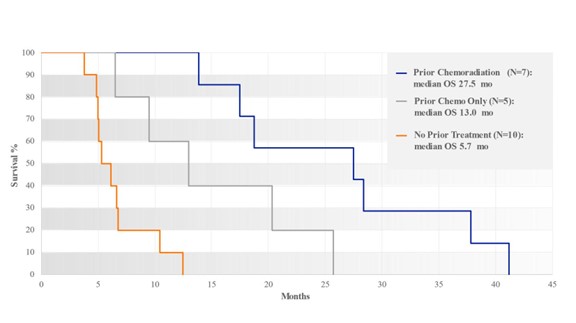

As in Phase I/II RenovoCath/Gem RR1, subjects with prior radiation and chemotherapy demonstrated longer survival than other subjects.

| 23 |

Subjects with Prior Chemoradiation Survived Longer than Subjects with Prior Chemotherapy Only

Figure 19: Survival as function of previous treatment received for RR2 registry study subjects. As in RR1 study, subjects with prior radiation and chemotherapy demonstrated longer survival than other subjects.

In summary, the results of the RR2 observational registry build on the findings of the Phase I/II RenovoCath/Gem RR1 study. The use of RenovoCath in this patient population can be undertaken with adequate safety, with adequate attention to procedural technique including careful use/manipulation of a guide catheter to prevent arterial dissection, and with the administration of peri-procedure antibiotics in patients with prior biliary stent/drain.

RR1 and RR2 Conclusions

Patients with LAPC treated with TAMP showed efficacy signals:

| ● | Survival of patients with LAPC following TAMP was similar to that observed in the previous Phase I/II RenovoCath/Gem RR1 study. | |

| ● | Patients with biliary stents or drains who received TAMP who received prophylactic peri-procedure antibiotics experienced no episodes of sepsis. | |

| ● | LAPC patients who received prior radiation and chemotherapy had longer survival than those without prior radiotherapy. | |

| ● | In the RR2 observational registry study, treatment via the Superior Mesenteric Artery (SMA) showed the greatest survival benefit. It is believed that this is a result of the high contact area between the SMA and the tumor tissue. | |

| ● | The registry study (RR2) results combined with the Phase I dose escalation study (RR1) further validates prior radiation and treatment location as predictors of overall survival (in combination, RR1 and RR2 data were statistically significant for these two variables). |

Based on the FDA’s safety review of our Phase I/II study and clinical outcome, the FDA allowed us to proceed to evaluate RenovoGem within our Phase III registrational clinical trial.

| 24 |

TIGeR-PaC Phase III Trial (RR3)

With completion of RR1 and RR2, we obtained FDA approval for Phase III IND study in February 2018 comparing TAMP with IA gemcitabine to standard of care. In the FDA pre-IND meeting, the FDA confirmed the study design and endpoints and indicated that this Phase III study should result in New Drug Application approval if successful. In April 2018, we obtained Orphan Drug Designation for the use of RenovoGem in patients with pancreatic cancer. Depending on the progress of the trial and the potential observed benefit of RenovoGem, we will evaluate submitting a request to the FDA for Breakthrough Therapy Designation.

The primary endpoint of the study is overall survival, from time of randomization until death. Secondary endpoints include but not limited to progression free survival and quality of life questionnaire results. The study is a multi-center, open-label, randomized active-controlled study of subjects with locally advanced pancreatic adenocarcinoma which is unresectable according to NCCN guidelines. The study is currently enrolling patients in the US.

The study design is as follows: all patients receive a four-month induction phase of IV chemotherapy and radiation prior to randomizing to 4 cycles (8 treatments) of TAMP or 4 cycles of continuation of IV chemotherapy. In December 2021, we amended the protocol for our Phase III clinical trial to only allow for SBRT radiation during the induction phase of the study. We had previously permitted both SBRT and IMRT. Patients receiving IMRT were required to complete 25 treatments prior to being randomized into our study. In comparison, patients receiving SBRT are only required to complete 5 treatments. IMRT is generally less tolerable than SBRT, and we had observed a higher drop out for patients on IMRT. While TAMP data versus historical controls predicts a much greater survival benefit, the TIGeR-PaC study is powered to detect a 6-month survival benefit.